In February 2022, VA expanded the Veterans Benefits Banking Program (VBBP) to provide more services to Veterans. The program now includes credit counseling, financial education, and financial counseling opportunities. This expansion, called VBBP 2.0, addresses the unique monetary challenges Veterans face and offers them a path toward financial wellness.

Financial or credit counseling

The National Foundation for Credit Counseling (NFCC) and the Association for Financial Counseling and Planning Education (AFCPE) offer VBBP participants one free consultation with a credit or financial counselor. An NFCC-certified credit counselor may be the best fit for those who want to get out of debt, avoid foreclosure or qualify for a first-time home purchase. An AFCPE-accredited financial counselor can help you create a personalized budget, spending plan or savings plan.

VBBP also includes VetCents, which is a financial education program created for Veterans and their family members to learn more about money management, emergency savings, and understanding credit. For more information and to get started with VetCents today, visit vetcents.org.

If you receive VA benefit payments through a pre-paid debit card or paper check, there’s also an easier, safer and more reliable way to receive them. With VBBP 2.0, your benefits can be deposited directly into an account you open with a participating financial institution. Direct deposit allows the benefits you have earned to automatically arrive in your bank account – on time, every time.

Perks of banking with VBBP

VA and AMBA teamed up to develop VBBP, which offers a long list of banks and credit unions to choose from, giving Veterans access to financial advice and educational programs offered by institutions that understand their unique needs.

Partnering institutions

Participating banks include large and small national and state-chartered locations, which all are insured by the Federal Deposit Insurance Corporation.

Credit union membership criteria varies by institution, which Veterans must meet before becoming members. Some institutions may also charge a small membership fee to join as well. All participating credit unions are insured by the National Credit Union Administration.

Find the bank or credit union that is right for you!

For more information

If you already have a bank account and would like to have your federal benefits electronically deposited, you can call VA at 1-800-827-1000 and provide your account information or visit va.gov/change-direct-deposit/.

To learn more about VBBP and how to start banking visit benefits.va.gov/benefits/banking.asp.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

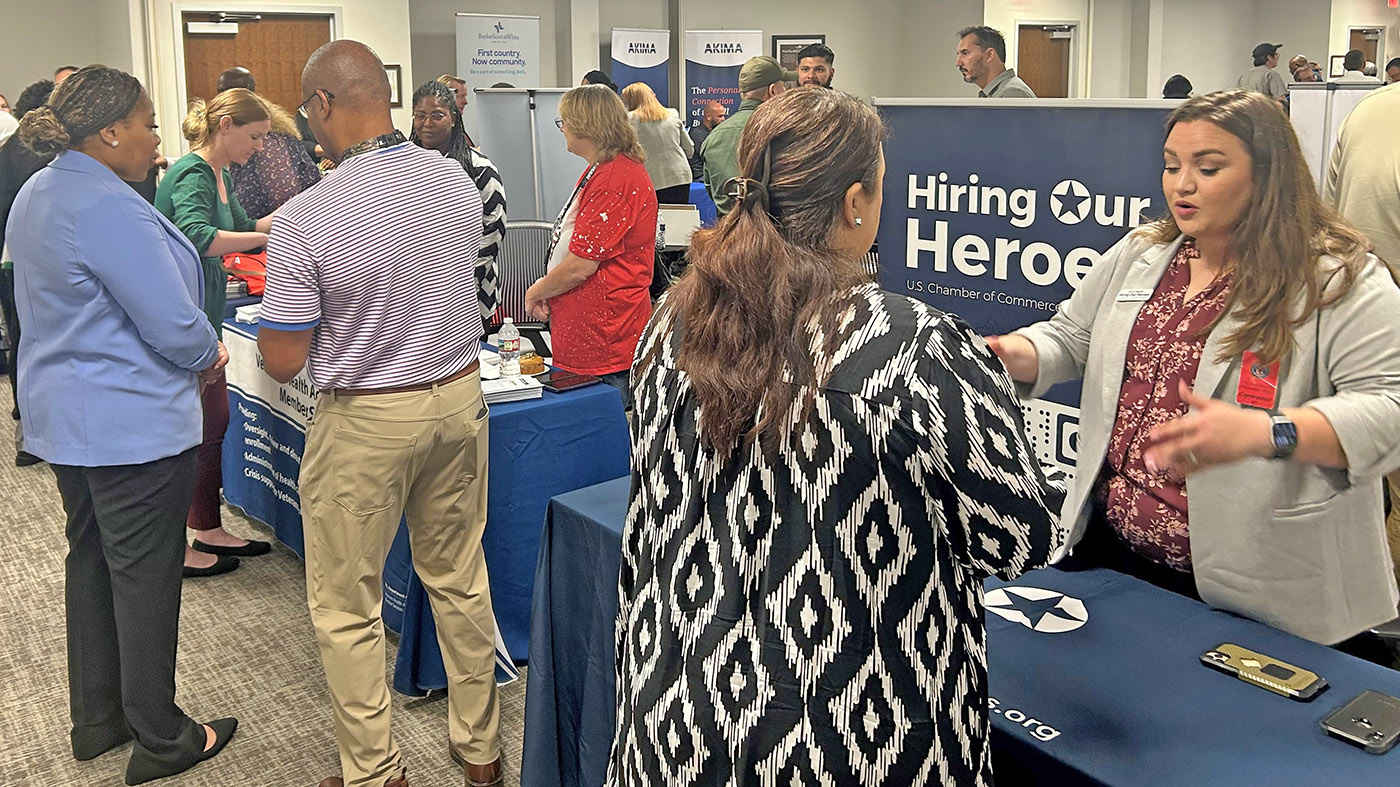

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

Thank you for the useful information!