Those of us working at the Department of Veterans Affairs get a daily reminder of why we’re here: “To care for him who shall have borne the battle, and for his widow, and his orphan.” Those words, by President Abraham Lincoln, are engraved on the entrance of our building.

To fulfill this mission–which of course includes women Veterans–VA is constantly improving clarity and transparency in all services, benefits and programs provided to Veterans, their families and survivors. Service Members Group Life Insurance (SGLI) is one the programs undergoing some changes and updates. Implemented by VA through Prudential Insurance, SGLI provides low-cost group life insurance to men and women in the military.

Updates to this important program include:

- Redesigned life insurance forms

- A new training module for Casualty Assistance Officers

- An updated website (with forms and Frequently Asked Questions)

- A new SGLI handbook

It is critical for this information to be as easy to read, understand, and use as possible and we trust that the extensive review of the SGLI materials provided the necessary clarity. For more information on SGLI and its updates, take a look at VA’s Insurance page, and the video below:

Thomas Lastowka is the Director of the Veterans Affairs Regional Office and Insurance Center in Philadelphia, Pennsylvania.

Topics in this story

More Stories

Summer can be a joyful time of year, but some outdoor activities can be hard for some Veterans. In this guest post, former VA Secretary Bob McDonald shares resources and plans to navigate summer activities.

"A CAPITOL FOURTH" airs on PBS Thursday, July 4, 2024 from 8:00 to 9:30 p.m. E.T.

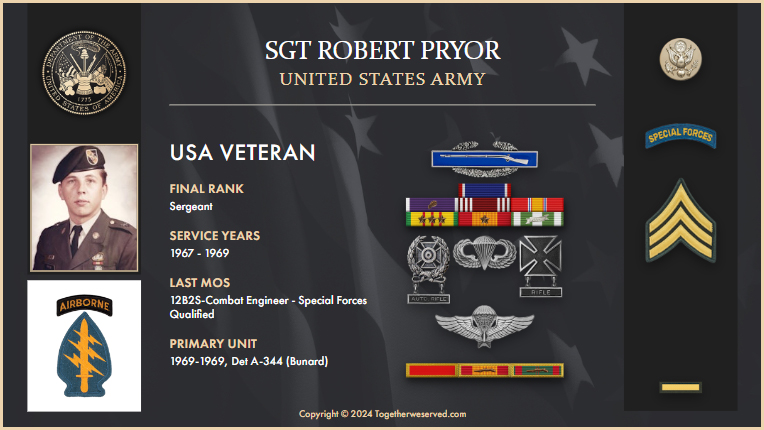

The following is an account from Army Veteran Robert Pryor on how he was able to find and reconnect with the pilot who saved his life in Vietnam.

My husband is 75, a veteran and not diabled, is there a life insurace policy through the veterans administation we can purchase?

It’s very important to protect yourself and your income, should you become injured and unable to work. Disability insurance is the best way to do that.

If you are a highly paid professional, there are great differences among the types of disability insurance plans available for income protection.

Veterans having contracting disability after their 65th birthday and are likely to stay in that disabled condition for at least six months are entitled to have the premium of their veterans policy waived by the Department of Veterans Affairs. Veterans who are permanently disabled should consult with the relevant authority in the VA to have the proceeds or the dividends of their policies delivered to them on a monthly basis.

Veterans also have the advantage of being able to borrow as much as 94 percent of the total value of their veteran’s life policy. This is applicable on their permanent plan by continuing to pay the premium of the policy in force. The interest charged is an adjustable rate that is adjusted on the 1st of October every year. So this works out to a reducing balance, which means that the total interest reduces as the loan amount is paid up gradually.

Alex,

Please let me know under which VA Under Secretary would the below article issue come under?

“Widows paying the Pentagon back!”

As the President of the Officers Association said, “… someone in the Pentagon should be really embarassed by this!”.

If a Veteran paid into an annuity; it should belong to his wife whether she remarries or not. It was the Veterans’s retirement pay the annuity payment was paid from; not the VA’s!

Does the VA really this is OK for our Veterans and their family members?

These deceased Veterans can’t speak for themselves; so it up to us–the Veteran’s Community to speak for them. How Very DISGRACEFUL!

57,000 military widows find themselves owing the Pentagon thousands of dollars. CNN’s Martin Savidge has the story.

******http://www.cnn.com/video/data/2.0/video/us/2011/01/14/savidge.military.widows.cnn.html **********************************************************

There was another such case of VA’s disgracefulness regarding the Veterans’s Family and/or Estate having to pay the VA for care that they received from Assisted Living at the VA.

Is this Veteran “benefit” run by the individual states and policy set by each State; or, is this the policy that comes from the VA? Is the VA supposed to have “oversight” over this benefit that is administered by each State Department of Veterans Affairs?

Most of us Veteran’s caregivers and family members were told that VA take so much of any income (retirement/pension) for their care if they are admitted to VA assisted living and no other charges would accrue other than that. This issue was just in the news a few months or so ago.

I would like to have someone from the VA comment on the two previous issues. It really would be nice if the Under Secretary responsible would speak to these issues–in the name of transparency and “we care”!

I can’t believe General Shinseki thinks these two examples of looking after Veterans and their family members are acceptable!!

Also, it would be nice if all Veterans and family members could be part of the VA monthly program that is open to the news people. It also would be nice if all Veteran’s organizations including those on the web such as VAWATCHDOGTODAY.com (Mr. Strickland) would be invited. Still too much information going one way…can’t fix an unhealthy system if we continue to make the same mistakes over and over.

Appreciatively,

Brenda Hayes

Vetwife Advocate

P. S. Alex, what’s the word from the House and Senate Veteran/family member caucus?

There are two types of disability insurance benefits awarded under VA life insurance policies. These are:

Waiver of premiums due to total disability and Total Disability Income Provision (TDIP) payments.

Waiver of Premiums

Most VA Insurance policies contain a waiver a premiums provision in the event that the insured becomes totally disabled. Generally, to qualify for a waiver of premiums, the insured must:

The insured must have a mental or physical disability which prevents him or her from performing substantially gainful employment.

The total disability must begin before the insured’s 65th birthday, and must continue for at least six consecutive months.

The total disability may not begin prior to the effective date of the policy. (Exception: waiver may be granted if total disability commenced prior to the effective date only on S-DVI policies, provided it is due to a service-connected disability.)

There are certain exceptions to the above conditions. However, if you believe that you are eligible for a waiver of premiums, you should apply as soon as possible. VA will determine your eligibility and notify you of the decision. Use VA Form 29-357, Claim for Disability Insurance Benefits which can be downloaded from the VA.GOV website or through your CVSO or NSO. In most cases, premiums can only be waived up to one year prior to receipt of a claim.

Total Disability Income Provision (TDIP) Rider

A TDIP rider provides for monthly payments to be paid to an insured starting on the first day of the seventh month of his or her continued total disability. Payments continue as long as the total disability continues. This provision is available on all NSLI policies, except S-DVI (“RH”) and VRI (“JR” and “JS”).

Policyholders must apply for TDIP before their 55th birthday and the applicant must be in good health.

Total disability income provision benefits are payable to individuals who:

Have a TDIP Rider in force on the date that total disability began or one year from when the rider ceases and…

Have a mental or physical disability (it does not need to be service connected) which prevents him or her from performing substantially gainful employment and…

Total disability must begin before the insured’s 65th birthday and

Must continue for at least six consecutive months…

If the insured is totally disabled and qualifies for TDIP payments, he/she is also entitled to a waiver of premiums on the basic contract and the TDIP rider. To apply use VA Form 29-357, Claim for Disability Insurance Benefits from the VA.GOV website or through your CVSO or NSO.

I’m 100% V.A. rated disabled does that mean I get free life insurance ? I have been told that the life insurance is free for me .

Mr. Lastowka,

I know this is not about compensation and pension but since you are from the regional office and the director maybe you can explain to me why the compensation and pension number has been busy since the change of the year? Why does it take 40 + days to obtain a signature? Why for almost a year i have recieve minimal information about the status of my claim in writing? I have had to call numerous times just to find out where my claim currently stands.

Would really like to know the answer to these questions.

Thank you,

John W.