Ever wonder what the difference is between Veterans’ Group Life Insurance (VGLI) and Veterans Affairs Life Insurance (VALife), the two life insurance programs offered by VA specifically for Veterans?

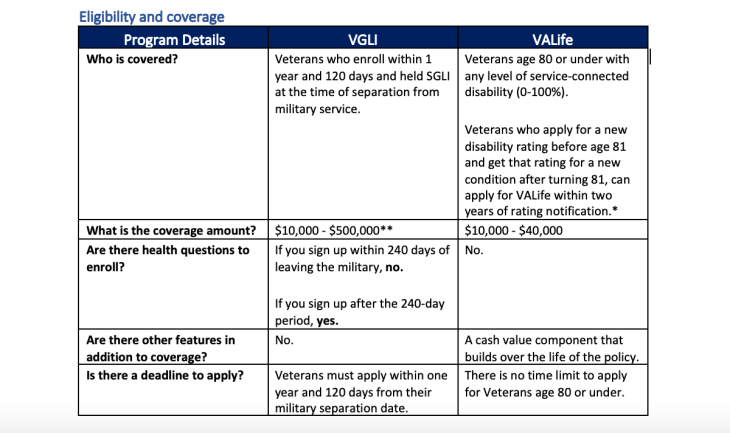

VGLI allows Veterans to convert and keep the term life insurance coverage they had under Servicemembers’ Group Life Insurance (SGLI) while VALife offers whole life insurance coverage to Veterans with service-connected disabilities (0-100%).

Veterans insured by VGLI and who are eligible for VALife can add VALife coverage to their plan, making the programs complementary to each other. VGLI-insured Veterans who add VALife to their coverage portfolio ensure higher coverage for earlier stages of life and continued coverage once term life coverage expires.

Some key differences between VGLI and VALife are coverage types, application timelines and amount of coverage available. Read more below to learn about the differences between the two programs and how Veterans can protect those who matter most with VA life Insurance.

Term vs. whole life insurance

VGLI is a term life insurance program. Term life insurance provides coverage for a set period of time. These types of policies typically provide higher coverage amounts at lower premium rates at younger ages. Term premium rates typically increase as you age. VGLI premium rates are found here.

VALife is a whole life insurance program. Whole life insurance provides coverage for the entire life of the policyholder—as long as premiums are paid—and typically offers lower coverage amounts at higher premium rates. Whole life policies like VALife can be considered an investment vehicle since they build cash value. Premium rates are lower the earlier you sign up and they will never increase for the life of the policy. VALife premium rates are found here.

*More information can be found online https://www.va.gov/life-insurance/.

** VGLI coverage is determined by how much coverage a Veteran held under SGLI. Effective March 1, 2023, SGLI and VGLI maximum coverage amounts increased from $400,000 to $500,000.

- Service members who separate on or after March 1, 2023, with $450,000 or $500,000 in SGLI coverage can convert that to an equivalent amount of VGLI coverage, as long as they apply for VGLI within one year and 120 days from their separation date.

- VGLI-covered Veterans who separated prior to March 1, 2023, will not see an automatic increase in their coverage. Eligible Veterans under age 60 who have VGLI coverage of $400,000 can increase their coverage in $25,000 increments up to the new maximum of $500,000 at designated anniversary dates.

Application process

Veterans can apply for VGLI through the Office of Servicemembers’ Group Life Insurance (OSGLI) here.

The VALife application and eligibility decision process is completely automated and online. Apply, receive an instant decision, and enroll in VALife online here.

Learn more

You can learn more about VGLI and VALife by visiting the program websites:

Topics in this story

More Stories

In this news post, we explore the various options designed to keep you in your home, offering hope and possible solutions for when/if you experience financial hardship.

Vietnam Veteran David Chee is among the many Native American Veterans and service members who have dedicated their lives to military service. Chee proudly served with the Army's 82nd Airborne, parachuting into the jungles of Vietnam. Chee now owns a home he purchased on Navajo tribal lands with the help of the VA Native American Direct Loan.

For Veterans, donating to charities—especially those that support fellow service members—feels like a meaningful way to give back to the community. However, Veterans and their loved ones must remain vigilant and learn to protect themselves from charity scams.