April is Financial Literacy Awareness Month, making it the perfect time to think about your plans for the future and how to ensure your financial portfolio is ready. A crucial part of this planning is life insurance, an important financial benefit that provides peace of mind to you and your loved ones. VA offers several life insurance options to meet the needs of our Nation’s service members and Veterans, such as Servicemembers’ Group Life Insurance (SGLI), Veterans’ Group Life Insurance (VGLI), and VA’s newest offering—Veterans Affairs Life Insurance (VALife).

Why is life insurance important?

Life insurance provides funds to help cover expenses upon your death. With the right policy and coverage amount, you can cover funeral expenses, provide income for loved ones or pay off outstanding debts.

What types of life insurance exist?

The two main types of life insurance policies are whole and term. Whole life insurance policies last the entire life of the insured and typically have lower coverage amounts at higher premium rates because they build cash value; premium rates are fixed for the life of the policy and will generally not increase. Premium rates are lower the younger you are.

Term life insurance policies are only in effect for a set period and typically have higher coverage amounts at lower premium rates, but there is no cash value accumulation; premium rates also increase as you age. Learn more about the differences between whole life and term insurance here.

What life insurance programs does VA offer?

VA offers life insurance programs to Veterans, service members and military families.

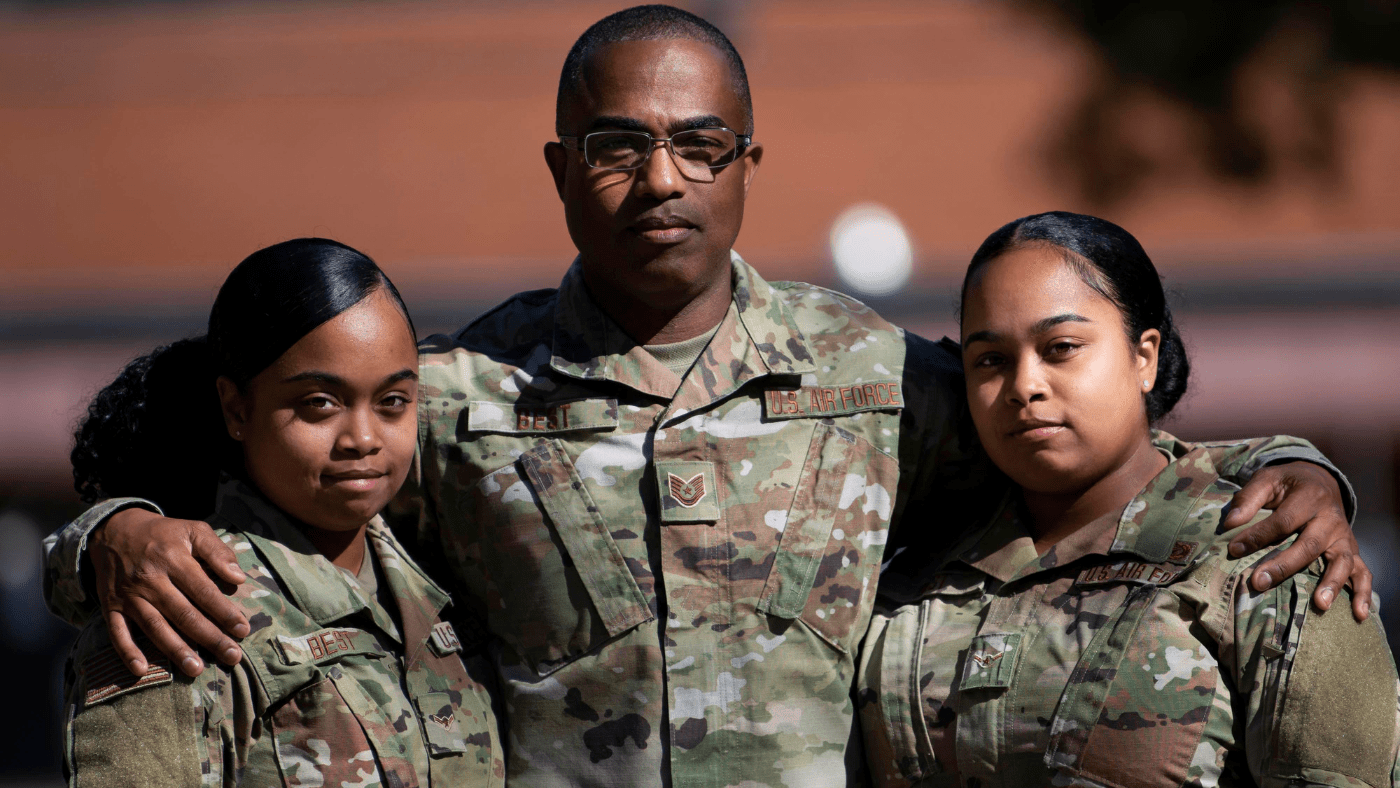

For service members and military families

Active-duty, National Guard and Reserve service members are automatically eligible to be covered under Servicemembers’ Group Life Insurance (SGLI), which now offers up to $500,000 in low-cost term life insurance coverage. TSGLI is traumatic injury protection coverage also included with SGLI up to $100,000.

Spouses and dependent children of service members covered by SGLI can also receive coverage under Family Servicemembers’ Group Life Insurance (FSGLI) . Spouses can have coverage up to $100,000 with a premium paid, and dependent children are covered for $10,000 at no cost to a service member who has SGLI coverage.

For Veterans

Veterans can choose to convert their term life insurance coverage after separation from service to Veterans’ Group Life Insurance (VGLI), which offers term life coverage equal to the amount held under SGLI. Veterans must apply for VGLI within one year and 120 days from their date of separation, and if they apply within 240 days following separation, they do not have to answer any health questions.

Veterans may also choose whole life insurance coverage through VA’s newest life insurance program—Veterans Affairs Life Insurance (VALife)—which offers guaranteed acceptance whole life insurance to Veterans age 80 or under with any level of service-connected disability (0-100%) and no time limit to apply. VALife offers up to $40,000 in coverage, has no health questions for enrollment, is fully automated online with instant decisions, has competitive premiums that will never increase for the life of the policy, and offers cash value that builds over the life of the policy after the first two years of enrollment.

Some Veterans with service-connected disabilities may also qualify for up to $200,000 in coverage through Veterans’ Mortgage Life Insurance (VMLI), which offers mortgage protection insurance for those who received a Specially Adapted Housing (SAH) grant to adapt a home to fit their unique service-connected disability needs.

Learn more

You can learn more about these programs by visiting va.gov/life-insurance.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

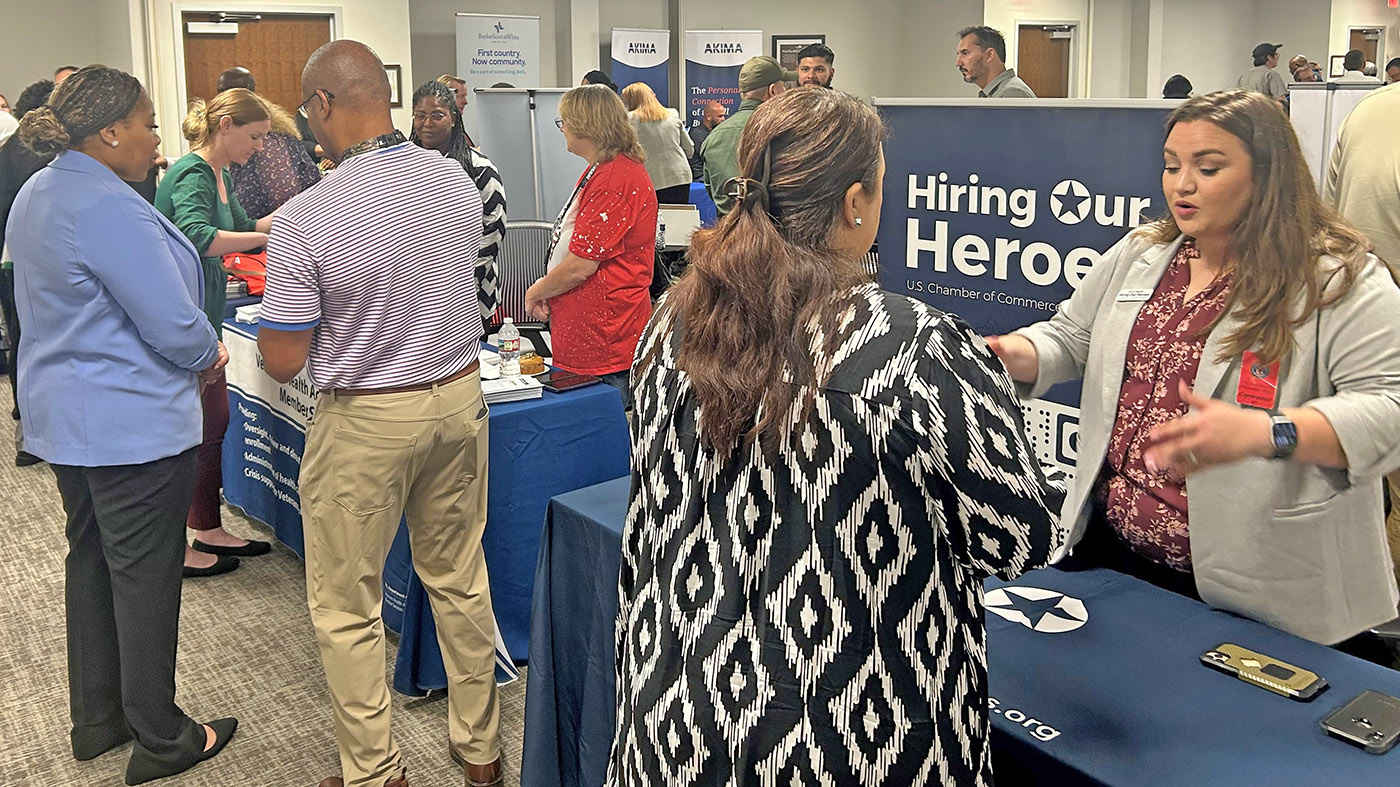

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

How can I receive documentation on my 10% Veteran Disability for my records?

i applied for \the va lifen insurance. i got to the point where they need identification i live in the philippines so i have no drivers license from the usa. i put in my govermant alien certificate of registration card an they rejected it. i want the insurance so please tell me why i cant use this card an what i can use thank u

Points to ponder – VA or military-related insurance isn’t always the best value for veterans. My husband and I first bought life insurance through USAA, which was cheaper than VSGLI at the time. Later, we learned about AAFMAA, which serves veterans, and it was even less expensive (it did require a medical exam). I have $200,000 term life for $14.40/month. Of course, everyone’s situation is different. Also, determine if you really need life insurance – likely if no one besides you is dependent on your income, you don’t need it.

Please send me the information by mail

I believe we are interested in insurance, but I am not sure between Whole or term at this time.