Almost 34 years ago, I made a decision that would change my life forever. Joining the military was not a difficult choice. Growing up with reminders of the Vietnam War broadcast near the dinner hour, and living in a community in which the military uniform was abundant, helped soothe my transition into the U.S. Air Force. My career was fulfilling and full of hard work. Sacrificing family life for service to my country certainly had its rewards, but on July 24, 2009, a day I will never forget, everything changed.

Almost 34 years ago, I made a decision that would change my life forever. Joining the military was not a difficult choice. Growing up with reminders of the Vietnam War broadcast near the dinner hour, and living in a community in which the military uniform was abundant, helped soothe my transition into the U.S. Air Force. My career was fulfilling and full of hard work. Sacrificing family life for service to my country certainly had its rewards, but on July 24, 2009, a day I will never forget, everything changed.

My career started in mid-1980 and I began flying in late 1983. Although search and rescue was not my unit’s primary mission, we responded to numerous aircraft mishaps and crashes within the next two and a half years. Nothing can prepare you for what you see when asked to help locate human remains at a crash site, but, I did it without question.

For the next two decades, I served as a flight engineer, spending a great deal of time in Southwest Asia, particularly during the Gulf War, Operation Enduring Freedom and Operation Iraqi Freedom. With the addition of the European theatre (NATO), my numerous deployments -ranged from 30 days to eight months and included countless missions and flying hours.

I returned to Saudi Arabia July 24, 2009, and for the next three weeks experienced nightmares, night sweats, constant anxiety attacks and extreme weight loss. I returned home after being in country for only four weeks. -My family physician referred me to VA and after extensive evaluation, I was diagnosed with delayed-onset Post Traumatic Stress Disorder. VA began an aggressive treatment plan to help me manage PTSD.

I was medically discharged from the Air Force while still being treated. While in the early stages of treatment, I failed to make the necessary connections for retirement and, most importantly, protection for my family in the event something happened to me.

I was shocked when I discovered that I couldn’t get private life insurance because of my PTSD diagnosis. I contacted more than five private companies, and each one told me that I was uninsurable. When I had about given up, I got a phone call from the VA Insurance Outreach Unit. The stress from not being able to protect my family was lifted when they told me I qualified for Veterans Group Life Insurance.

VGLI is lifetime renewable group term insurance that is available to active duty, Reserve and Guard Service members who separate with Service members’ Group Life Insurance coverage. Members must apply within one year and 120 days of separating from service, or of being placed in the Individual Ready Reserve.

It’s important to remember that you can qualify for VGLI insurance without answering health questions if you convert your SGLI to VGLI within 240 days of separation or of being placed on Individual Ready Reserve. I highly recommend that you protect your family in those first 240 days so that you don’t have to worry, like I did, about whether you will qualify for insurance.

I hope my story will serve as a testament for Veterans, because I feel that no matter how each one of us separates from the military, VA is there to help make the transition to a civilian life a little easier.

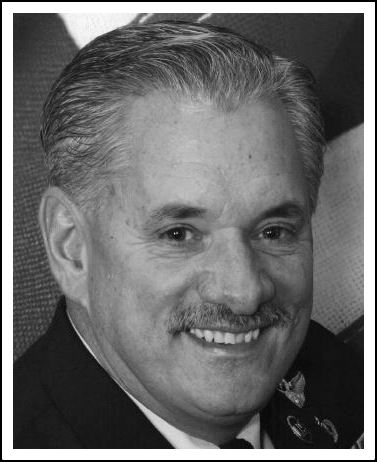

Charles D. Lee III, CMSgt (Ret.) is a U.S. Air Force Veteran.

Topics in this story

More Stories

The Social Security Administration is hoping to make applying for Supplemental Security Income (SSI) a whole lot easier, announcing it will start offering online, streamlined applications for some applicants.

Yusuf Henriques, an Army Veteran and former combat medic, is the founder and CEO of IndyGeneUS AI, a genomics company on a mission to improve health equity by increasing representation of women and racial minorities in clinical trials.

Online shopping scams are the riskiest scam for Veterans, with 77.3% of reports confirmed losing money when targeted by this scam.

I am a veteran, and I’m looking Experience with VGLI. I thank you for sharing.

I was refused VGLI after serving 22 plus years because I missed the cut off date by a couple of days…really..Im still upset about that event..Im sure they could of did some kind of wavier

I wonder why this isn’t being offered to ALL veterans now. I don’t recall being offered this when I got out.

Veterans’ Group Life Insurance has been available since 1974. However, prior to 1992, Veterans could only keep VGLI for 5 years after converting from SGLI after separation. Since 1992, VGLI has been lifetime renewable, allowing Veterans to keep their insurance as long as they continue to pay premiums.

Veterans have one year and 120 days to obtain VGLI after separation and up until November 1, 2012, separating Servicemembers who applied within the first 120 days of that time period could obtain the coverage without any review. Today, VA has extended that “no-health review” time period to 240 days from separation. During the remaining application period, members must answer health questions and may have to undergo a health review to obtain VGLI.

VA alerts Veterans to the valuable benefits of VGLI through a series of mailings sent after separation. These mailings are sent to the address Servicemembers inform their branches of service is their new address after leaving service.