When embarking on the journey to homeownership, don’t forget to focus on the most important step—ensuring you can secure the best loan. Not doing so could cost you money or even the ability to purchase your dream home.

To navigate the complex process of applying for a home loan, you need to be informed and be prepared. Understanding why loan applications are denied can save you from disappointment and keep your homeownership dreams alive.

Common reasons for denial

Application errors: Ensure your paperwork is accurate, consistent and complete. Inaccurate, unverifiable or missing information can derail almost any application. It is helpful to understand that your employment history, earning history and prior cost of living will be examined and verified throughout this process to ensure you can qualify for your proposed loan amount.

Credit rating: Regularly check your credit report for any errors or inaccuracies. You can obtain a free copy from major credit bureaus, like Experian, Equifax and TransUnion at AnnualCreditReport.com. If you find errors, dispute them through all three credit bureaus. Also remember, when you start this journey, if you incur new debt—like purchasing a new car or credit purchases—these impact your credit profile and could ultimately determine whether or you qualify.

Job stability: Lenders are typically looking for reliable and stable earnings, with two years of employment in the same industry. If you have been in your job for less than two years, you will need to illustrate how your prior education, training or experience has aligned you to promote your continued job stability. Be prepared to provide tax returns, pay stubs and additional employment verification documentation to support the loan request.

Appraisal issues: Understand the difference between an appraisal and a home inspection. VA-guaranteed home loans require that all purchase loans have an appraisal. This is required to confirm the home you are buying has the value to justify the loan amount. The appraisal will also ensure the home meets basic minimum property requirements, such as being safe, sound and sanitary. VA strongly recommends you also obtain a home inspection, which is your chance to inspect all features of the home you’re buying. This means an inspector will examine appliances, electric systems, plumbing systems and give you an idea of the overall condition of your future home.

Steps to take if denied

Consult with your lender: Seek out clarification on the denial reasons; lenders are legally obligated to inform you. Use this information to understand what potential credit improvements you need to undertake to be approved. This may mean to paying off certain obligations or making timely payments on all outstanding debt you have for potentially the next 12 months.

Apply with other VA-approved lenders: VA-guaranteed home loans are issued by various private lenders, and they may have differing requirements. If one lender denies you, consider applying elsewhere. Remember, interest rates fluctuate daily.

Don’t be disheartened if your application is denied. Take the time to understand why, remedy the issues and explore your options. By doing so, you bring yourself one step closer to homeownership.

For additional guidance, call 877-827-3702 or visit Benefits.VA.gov/HomeLoans.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

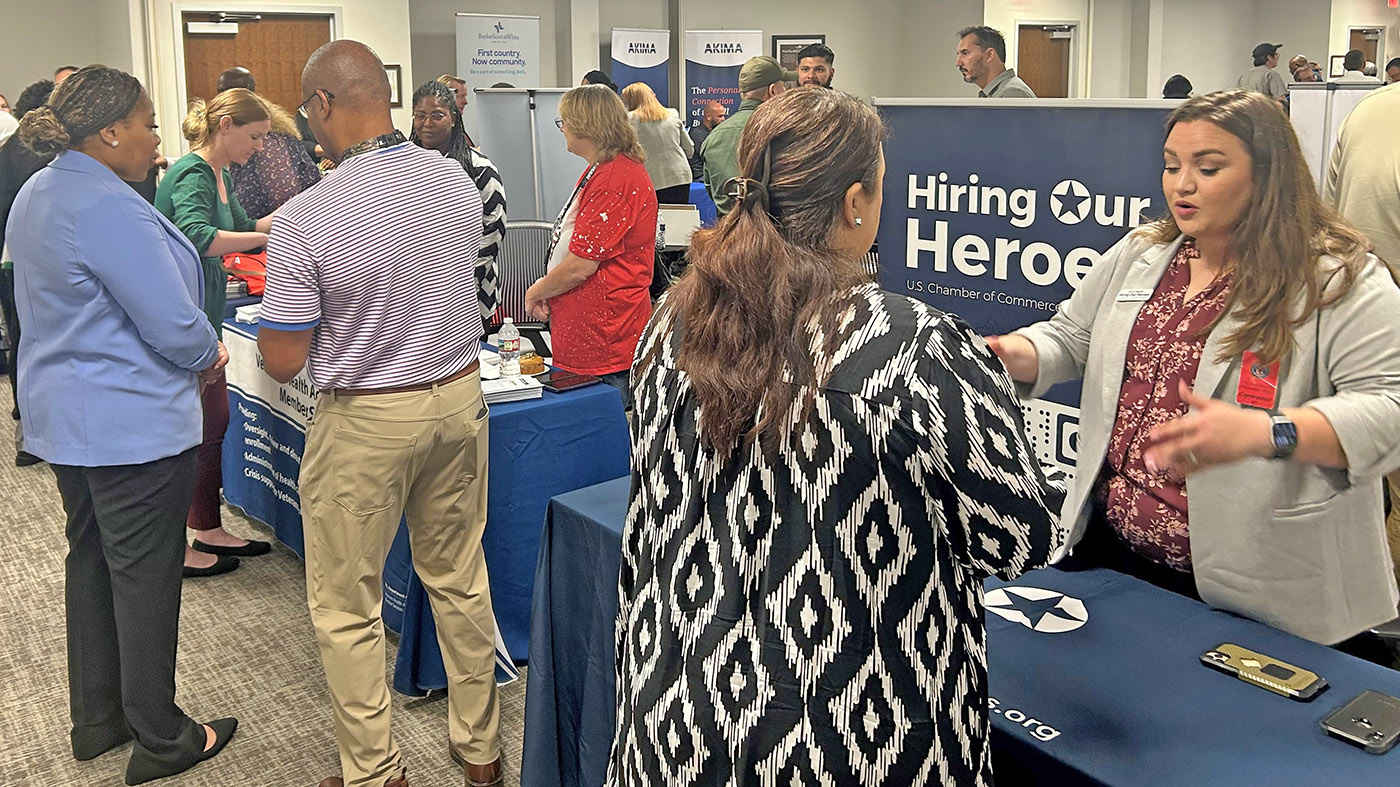

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.