Tax season can be stressful. It’s already a time filled with anxiety and urgency and, even worse, an opportunity for tax fraud and identity theft scams. Filing season has become a popular time for scammers to target unsuspecting taxpayers through multiple communication avenues. VA wants Veterans to remain vigilant against cyberattacks aimed at stealing personal and financial information.

To prevent falling victim to scams, VA encourages you and your family to follow these best practices:

- Maintain healthy cyber habits

- Utilize strong passwords for all devices

- Change passwords frequently

- Enable multi-factor authentication on all accounts

- Set security software to update automatically

- Encrypt devices

- Do not share personal data. Never share personally identifiable information (PII), such as your VA National Call Center personal pin, date of birth, military entrance/discharge information, branch of service, or Social Security Number (SSN) if requested via mobile communications or hyperlinks. Do not open suspicious emails or attachments or click on links from unknown sources. If in doubt, call VA directly at 1-800-827-1000.

- Use multi-factor authentication. Visit this VA webpage for more information on verifying your identity and obtaining a VA Security Personal Identification Number (PIN). A VA Security PIN is an additional way to secure direct deposit accounts from theft and protect PII.

- Get an IRS Identify Protection Personal Identification Number (IP PIN). IP PINs are assigned to taxpayers to help prevent SSN misuse on fraudulent federal income tax returns. SSNs can be used to commit tax fraud by filing a fraudulent return, claiming a refund, or credit. To prevent someone else from filing a tax return using your SSN, obtain an IP PIN.

- Remember: VA benefits are tax free. Before filing a tax return, review the VA Benefits tax exemptions. Compensation, Pension, Veteran Readiness & Employment, and Education payments are tax-free and should not be included as income on a federal tax return.

VA recognizes the importance of identity safety during this tax season and remaining vigilant year-round. If you miss a VA benefits payment, identify a discrepancy in payments, or find suspicious activity with your direct deposit account, contact the VA immediately at 1-800-827-1000. Learn more about identity theft prevention strategies at the VA Identity Theft Prevention webpage.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

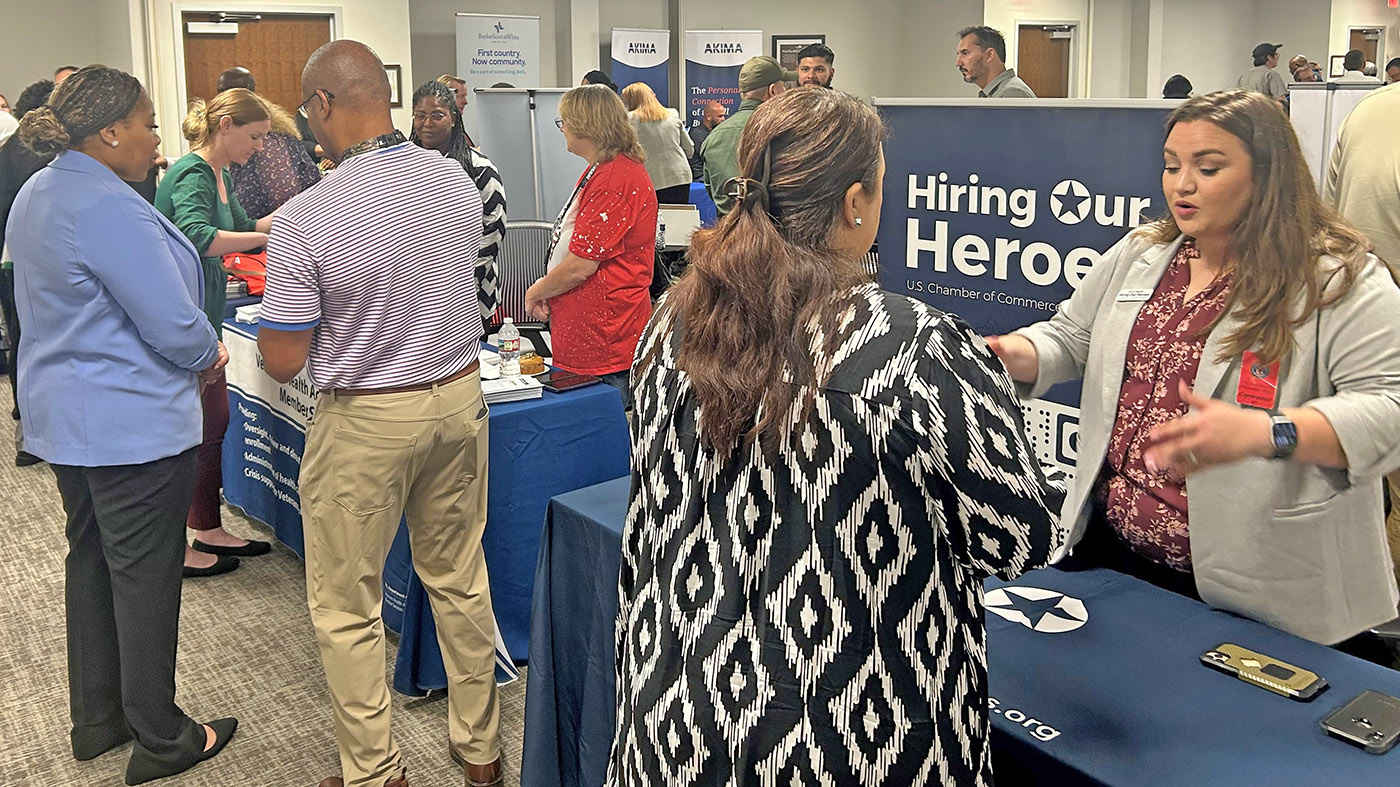

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

Need a tax person