Waiting for a benefit check to be delivered in the mail is a slow and tiresome process. Checks can also be lost or stolen. Thankfully, VA’s Veterans Benefits Banking Program (VBBP) has helped thousands of Veterans and their families make the conversion to direct deposit, which is quick, easy and secure.

In fact, VBBP has surpassed 100 participating financial institutions and converted more than 340,000 benefit recipients to direct deposit since its launch in 2019. The 100th financial institution to participate in VBBP was PlainsCapital Bank, and the 101st was Frontwave Credit Union.

With the assistance of the Association of Military Banks of America (AMBA), VA launched VBBP to help Veterans, beneficiaries, caregivers and survivors open accounts and enroll in direct deposit for their VA benefits.

VBBP-participating institutions also help Veterans access traditional products and services via this financial network and encourage financial inclusivity that results in Veterans saving more, building wealth and accessing credit.

“Thanks to VBBP, VA officially reached 101 participating financial institutions and a new highpoint in conversions in February—averaging over 1,700 per week,” said Under Secretary for Benefits Josh Jacobs. “Receiving benefits through direct deposit is faster and safer than a mailed check and lowers the risk of missed payments and fraud.”

VBBP leverages a group of military and Veteran-friendly financial institutions that have experience dealing with the unique financial issues facing the military and Veteran communities.

In 2022, VA and AMBA expanded VBBP to include free financial and credit counseling, as well as free financial education programs (VetCents and Veteran Saves) to help Veterans and their families achieve financial resilience, increase savings, gain economic stability and more.

All participating banks and credit unions are federally regulated, as well as FDIC or NCUA insured.

Learn more about VBBP.

Topics in this story

Link Disclaimer

This page includes links to other websites outside our control and jurisdiction. VA is not responsible for the privacy practices or the content of non-VA Web sites. We encourage you to review the privacy policy or terms and conditions of those sites to fully understand what information is collected and how it is used.

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

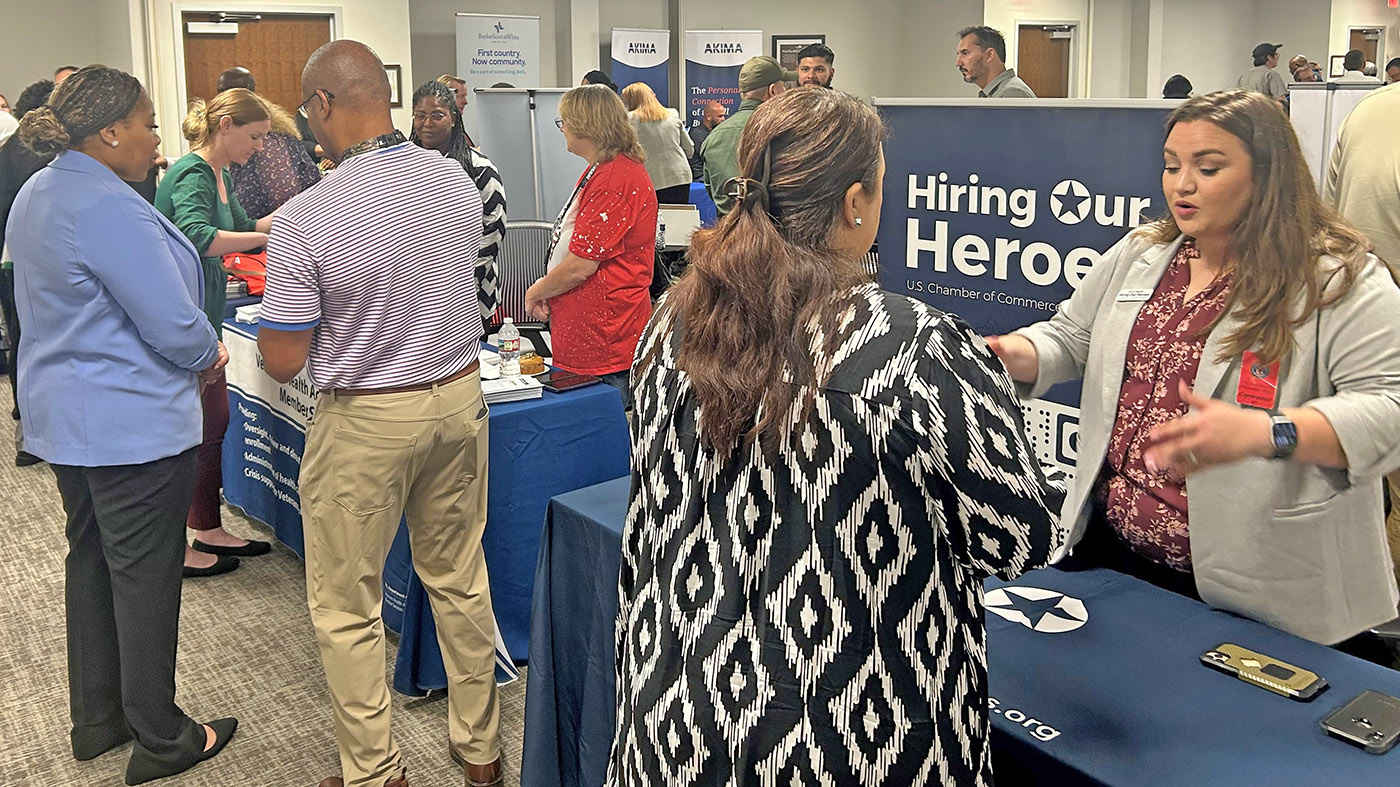

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

I think it’s a mistake letting VA handle your money. Everyday the VA wastes tons of money with what seems like zero accountability.

It would be nice if the VA would provide dental

Care for all Veterans several politicians have tried to introduce this but it never gets done

Oral health is just important as medical health

We don’t need more advice on baking