There can be many reasons to refinance your home mortgage. You might be looking to lower your interest rates, take out equity or shorten the length of your repayment time. The financial flexibility of a refinance loan is sometimes just the solution needed for home improvement projects, too. If you’re a Veteran or active-duty Servicemember, it can be worth your while to explore VA refinancing options.

There can be many reasons to refinance your home mortgage. You might be looking to lower your interest rates, take out equity or shorten the length of your repayment time. The financial flexibility of a refinance loan is sometimes just the solution needed for home improvement projects, too. If you’re a Veteran or active-duty Servicemember, it can be worth your while to explore VA refinancing options.

Like other kinds of refinancing options, a VA refinance can be used to:

- Lower monthly payments. If you go from a higher to a lower interest rate, you can see your monthly mortgage bill go down.

- Shorten the term. Many owners want to pay off their houses sooner so they obtain a VA loan that spans a shorter amount of time than the original. For example, refinancing a 30-year mortgage into a 15-year. This has the added benefit of no pre-payment penalty, so if the borrower wanted and was able to pay it off sooner, he or she could, without having to worry about pre-payment fees or charges. Shorter terms also build equity faster than the longer terms.

- Take advantage of equity. Take equity out of the home and use it to pay for a variety of things. Common uses for this are consolidating or paying off debt or credit cards, paying for college or home improvements. Best of all, you’ll obtain low VA rates.

- Lock in a fixed rate. Many homebuyers find themselves with Adjustable Rate Mortgages (ARMs). These interest rates change every year. Sometimes they may go up; other times they may go down. It all depends on the market. The interest rate directly impacts the amount of the monthly mortgage payment.

One of the first questions current homeowners ask is, “Can I get a VA refinance even if I don’t currently have a VA loan?” That depends on what type of refinancing option you are seeking. An Interest Rate Reduction Refinance Loan (IRRRL) or Streamline Refinance is only available to those with an existing VA loan. A cash-out option does exist, however, and is available to anyone who meets the eligibility requirements, even if the original loan is not through VA. The differences between the two are that:

- IRRRLs or Streamlines can only be used in cases where there is an existing VA loan. These types of refinancing options can lower monthly payments and get you a lower interest rate. You cannot get cash back from these; however, they can be used on property that you do not live in, which is an added benefit. The process is usually very quick, since VA already has all of your necessary documentation.

- Cash-out options can be used with any type of existing mortgage. This is a good choice if home values have risen dramatically since you purchased your house, or you need the equity in your home to pay other debts. There are restrictions on what you can use equity for, however; it cannot be for frivolous purposes.

Eligibility Requirements Must Be Met For Refinancing

Although these types of VA home loans can be used to replace conventional ones, the homeowner still must meet the basic eligibility requirements of the VA program. Namely, the homeowner must be a current or former member of the U.S. military or the surviving spouse of a Veteran. Members of the National Guard and Reserve may qualify, too. Talk to a qualified VA lender to determine your eligibility.

Topics in this story

More Stories

Summer can be a joyful time of year, but some outdoor activities can be hard for some Veterans. In this guest post, former VA Secretary Bob McDonald shares resources and plans to navigate summer activities.

"A CAPITOL FOURTH" airs on PBS Thursday, July 4, 2024 from 8:00 to 9:30 p.m. E.T.

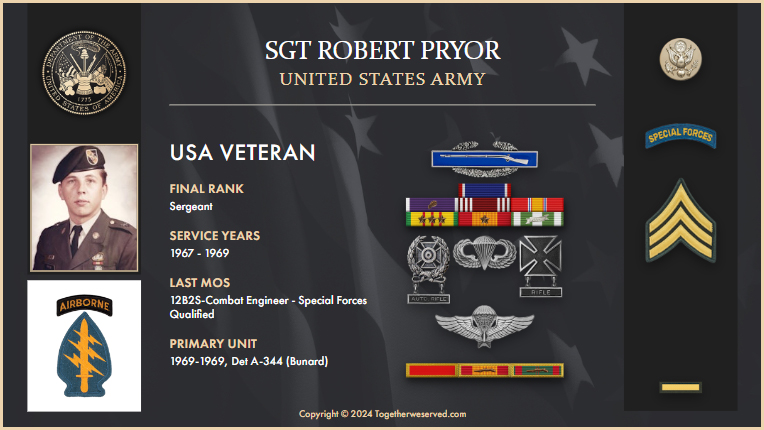

The following is an account from Army Veteran Robert Pryor on how he was able to find and reconnect with the pilot who saved his life in Vietnam.

My husband is 100% disabled and we live in St.Petersburg, Florida. We have a house in Ohio which I’d like to refinance as we still owe about $95,000, but not sure if I qualify. The house in Ohio was put in my name originally. Would appreciate hearing from you if anything is possible! Thank you!

Can anybody help me? I had a V.A. Loan on my first house. My health got bad and I list my job. And, lost my house to a predator loan mortgage co. Is there anyway I can get forgiveness from the V.A., for this loan. I have doctor records and proof of my sickness. Now, I’m 100% DAV and would like to buy my another home…thank you

I am a 100% 77 yr disabled Vet retired Chief have home with loan

can pay down on mort, no bills other than current mort

paymt, have income, ssn, ret pay, disb pay. Please show me how you can help me

Merrill W. Gitlin