This year, VA will pay $88.1 million in annual dividends to approximately 430,000 Veterans who served before 1956 and hold qualifying life insurance policies. The dividends come from the earnings of trust funds that Veterans have paid insurance premiums into over the years, and are linked to returns on investments in U.S. government securities.

VA will pay the following dividends:

- $53.5 million – Anticipated total amount of dividends to qualifying Veterans of World War II holding National Service Life Insurance policies that begin with the letter “V”.

- $2.3 million – Anticipated total amount of dividends to be paid to qualifying World War II-era Veterans holding Veterans Reopened Insurance policies that begin with the letters “J,” “JR” or “JS”.

- $32.2 million – Anticipated total amount of dividends to be paid to qualifying Korean Conflict-era Veterans holding Veterans Special Life Insurance policies that begin with the letters “RS” or “W”.

- $105,000 – Anticipated total amount of dividends to be paid to qualifying Veterans who served after World War I until 1940 and hold U.S. Government Life Insurance policies that begin with the letter “K”.

No action is required on the part of the Veteran receiving dividends. VA will automatically pay the dividend on the anniversary date of the policy by sending it to the insured Veteran. The amounts will vary based on the age of the Veteran, the type of insurance and the length of time the Veteran has had the policy in force.

Veterans eligible for the dividends must have had these VA life insurance policies in effect since they left the military and would have received annual notifications about their policies.

VA operates one of the nation’s largest life insurance programs, providing more than $1.2 trillion in coverage to 6.3 million Servicemembers, Veterans, and family members. Veterans who have questions about their policies should contact the VA insurance toll-free number at 1-800-669-8477 or send an email to VAinsurance@va.gov.

For more information on VA life insurance, see http://www.benefits.va.gov/insurance/.

About the author: Maryann Stupka has worked for VA for 28 years and is Chief of the Insurance Actuarial Staff, which is responsible for determining the annual dividend distribution.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

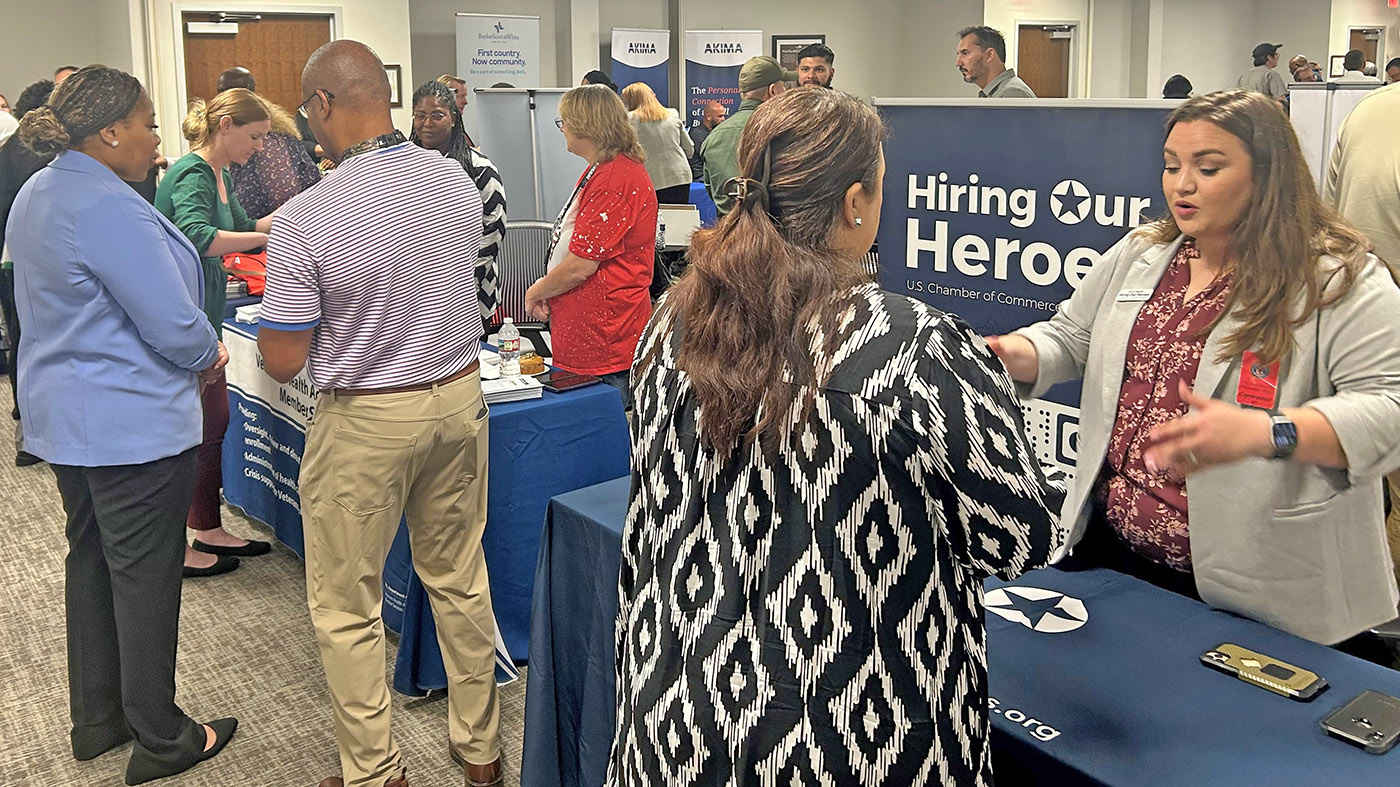

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

Why are the life insurance policies jack up when you reach 60 yrs old? Veterans get screwed when you older! We can not afford your rates! Our health prevents us from buying civilian policies!

It’s hard to find experienced people on this topic, however,

you seem like you know what you’re discussing!

Thanks

I want to know why after 6 years in the Army Reserves I am not considered a vet, just because I was not deployed.

whoever says your not a Vet doesnt know what they are talking about …i help veterans with VA loans through my bank and all you need is : 5. Basic Eligibility Requirements ,continued,

c. Eligibility for

Reserves and/or

Guard

Members of the Reserves and National Guard who are not otherwise eligible

for loan guaranty benefits are eligible upon completion of 6 years service in

the Reserves or Guard (unless released earlier due to a service-connected

disability). The applicant must have received an honorable (a general or

under honorable conditions is not qualifying) discharge from such service

unless he or she is either:

• in an inactive status awaiting final discharge, or…

please call me if you need further assistance…

Will any dividends be paid to Viet Nam veterans who have a life insurance policy that has letters SDVI?

I served from December 1965 until December 1967 and then was place on an inactive National Guard status until 1971.

Thanks for your help with my question.

Harold, thank you for your service! No, VA does not pay dividends on SDVI policies.

Insurance programs pay dividends when the premiums exceed the costs of claims and administrative costs. Therefore, insurers can pay dividends when their insureds’ mortality is less than expected. SDVI insures individuals who are in poor health due to their service. Due to this, the claims exceed premium income and VA must request appropriations from Congress to support the program. Therefore, the SDVI Program does not have excess premium income to return to policyholders.

I have been paying for a VGLI insurance policy since I retired from the USAF in Dec 1994. Does that policy or will that policy ever pay dividends like my other life insurance policies do?

Danny, thank you for your military service! Referencing Veterans Group Life Insurance (VGLI) – No, VGLI does not pay dividends.

Insurance programs pay dividends when the premiums exceed the costs of claims and administrative costs. Therefore, insurers can pay dividends when their insureds’ mortality is less than expected. VGLI insures individuals who are in poor health due to their service,. Due to this, VGLI mortality is higher than a private insurance policy where a health review is required to be insured. Therefore, the VGLI Program does not have excess premium income to return to members.

My father was in WW2 and he served from 1942 to 1946 and he had the life insurance and we can not find his paper work, my father was shot in the leg and there is no documents of him being shot, my dad told me that it was covered up because they did not know if it was enemy fire of friendly fire, but we do not have any documentation on this matter. As for his life insurance, he had his life insurance, so I would like to know if this applies to him.

Thank you Robert D Harris Sr and his daughter Pilar J Harris.

A little late now that most of them are deceased!! What then??!!