The Government National Mortgage Association (Ginnie Mae) and VA announced the formation of the Joint Ginnie Mae – VA Refinance Loan Task Force.

The task force will focus on examining critical issues, important data and lender behaviors related to refinancing loans, and will determine what program and policy changes should be made by the agencies to ensure these loans do not pose an undue risk or burden to Veterans or the American taxpayer.

More specifically, the task force will examine aggressive and misleading refinancing propositions, as described by the Consumer Financial Protection Bureau, and will address loan churning and repeated refinancing.

Both agencies agree that VA and Ginnie Mae programs work best when they are used by market participants in ways that provide a benefit to Veteran borrowers and, ultimately, lower Veterans’ costs.

The task force has started its work by examining data and information to ensure loans provide a net tangible benefit to Veteran borrowers, and consider establishing time frames regarding recoupment of fees associated with refinancing loans.

It will also examine the impact of establishing stronger seasoning requirements for VA-guaranteed loans that are securitized into Ginnie Mae Mortgage Backed Security pools. Additionally, the task force will work to ensure Veterans understand the costs and benefits of refinancing, and ensure robust borrower outreach and education programs are augmented for this purpose.

Ginnie Mae and VA will arrange joint discussions with individual lenders whose demonstrated origination practices may negatively affect Veteran borrowers or increase program costs and risks.

The task force will continue to work collaboratively until concrete solutions have been implemented to eliminate lender behavior that is unhelpful to Veterans and harmful to the American taxpayer.

Topics in this story

More Stories

On Thursday, June 20, 2024, VA joined more than 20 federal agencies to release its updated 2024-2027 Climate Adaptation Plan.

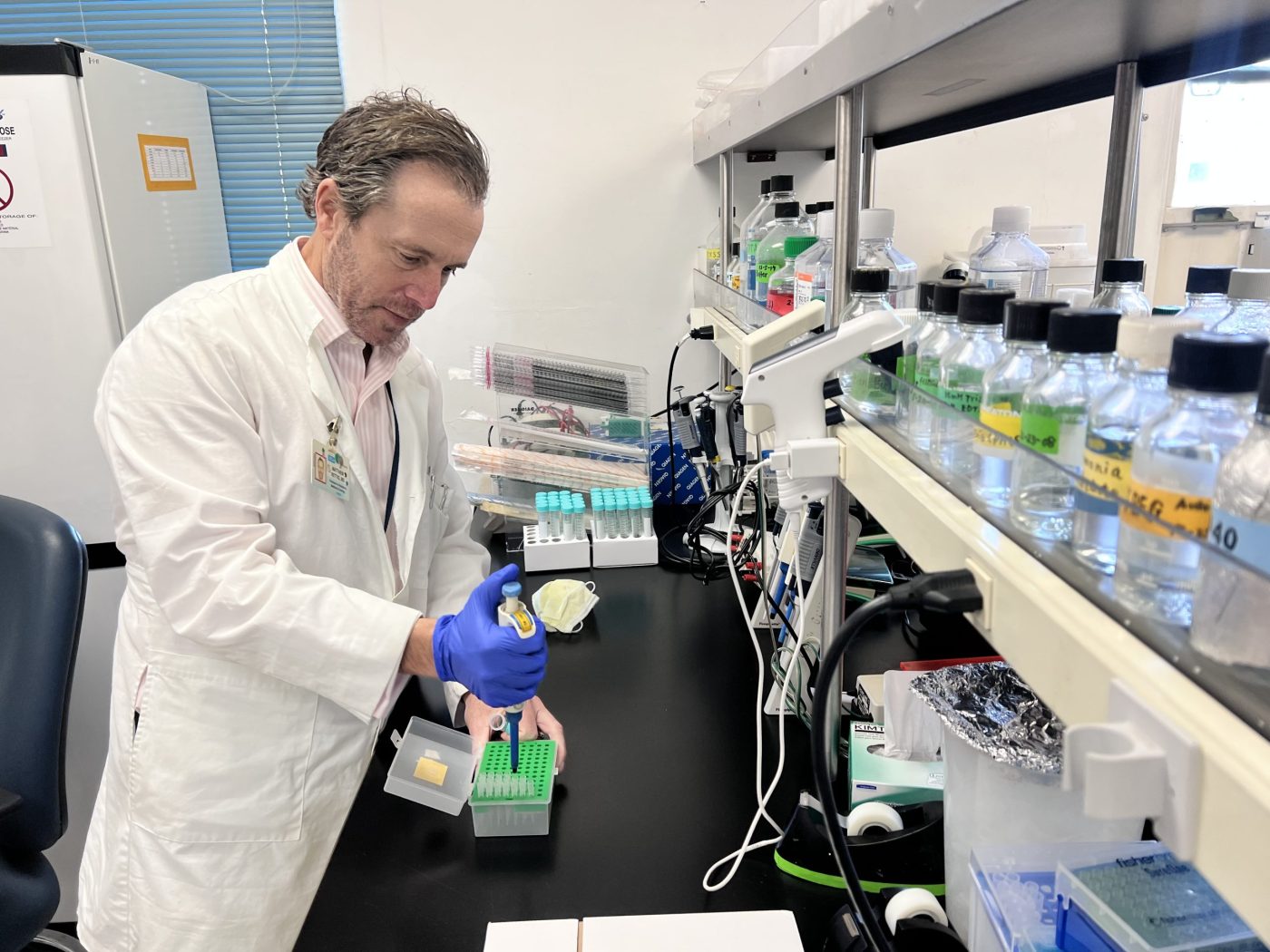

As part of a new research study that began July [...]

WASHINGTON ― The Department of Veterans Affairs Office of Research [...]

Veterans can refinance 100% of their loans. 80% LTV is n/a.

good luck.

VERNON

Noah,

Thanks for your service. I am just a guy in WV who saw your comment. Has anyone reached out to you? I want you to know that others do care. I care. I am a veteran from the Persian Gulf era, and have a friend that works with vets on these anxiety and panic issues. I don’t suffer from this, but I have it in my family so I can see the costs. I am sorry for your pain and problems, and I thank you for your service.

Sometimes help, starts with some guy that cares for another guy. May God help guide us to get you the help you need.

Peace. & Thanks!

Steve Blackwell

Sorry, I meant 80% LTV

Our mortgage is under the VA loan. Seeking home improvement assistance to renovate old kitchen to be more user-friendly for my husband’s and my disabilities. We are both SC for disabilities but do not quality for grant. We also cannot access our equity because of 89% LTV.

Do you have any suggestions? Thank you.

Hello to whom it may concern, my name is Sparks, Noah R. and I live at (redacted) Brown wood Tx. (redacted). I’ve tried repeatedly to get the medical help I need and was promised when I left college in 2003 to enlist in the Army and have received nothing but contempt, a general lack of compassion, highlt questionable treatment to put it mildly, I have witnessed Men (Veterans from WWII, Korea, and every conflict since) treated with outright disdain let alone the lack of medical responsibility that would be categorized as malpractice in a court, I know bc I’m discussing my case with lawyers presently although I don’t want to have to go that route bc I’m not a “sue” type, but after paying for highly expensive private care and meds when I certainly earned not only free VA care but more importantly intelligent care. I’m also curious about where my guarantee home loan no stands bc I have little doubt that’s probably nothing close to my contract I’ve kept for when I’m ready to apply for a mortgage? Please help me I can hardly work and yet I received only 10% disability bc although a nice man I’m sure, my Dr. at my compensation appointment after receiving my honorable discharge did not speak English very well at all and come to find out he wrote down the exact opposite of the symptoms I was experiencing at the time that have only gotten worse. Surely someone out there cares about us???? (Then again I’ve buried 3 of my brothers who took their own lives bc of a direct connection to their maltreatment or being ignored outright) A “psychologist” actually said my severe acute anxiety/panic disorder was a “phase” and took me off my meds ultimately costing me my job AND Fiancé. PLEASE HELP!!!

Hi Noah ! I will b praying for u brother ! I can somewhat relate when i was going through my appts with the VA docs my Compensation doctor ! who had just retired from being a state compensation Doctor for N.Y. employees.Quietly said to me we all know why your here – For the money ! at that time i saw him i was with a cane and had a cast on my ankle, in any case, after viewing the report he had written up which the V.A had sent me. He had stated my Gait was fine, nothing of the reference of the cast i had to wear. he was off in more ways than one . well upon writing to the V.A. stating how inept this Doctor was ! Had to wait for the next compensation appt, after that, the result was Honest and more favorable . The D.A.V. was a big Help in this . God Bless .

Am interested in a direct home loan by VA