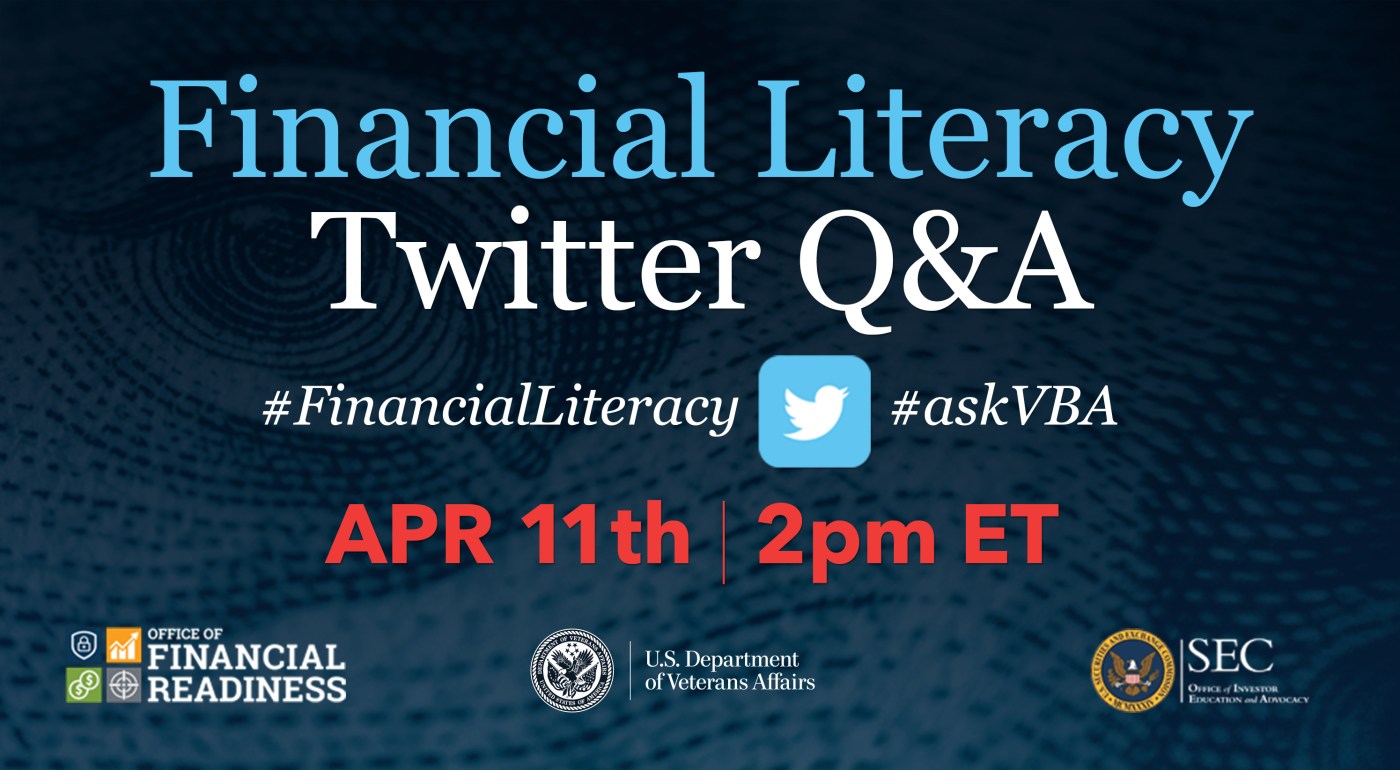

On Thursday, Apr. 11, the Veterans Benefits Administration’s social media team hosted a Twitter Q/A with the SEC’s Office of Investor Education and Advocacy and the DoD’s Office of Financial Readiness to chat Financial Literacy.

We wanted to call it “How to spend and invest your money gooder,” but since April is actually National Financial Literacy Month, we settled on “Financial Literacy Q/A.”

Since our Veterans and transitioning service members often receive five- and six-figure lump-sum benefits payouts and bonuses, we teamed up with our partners, above, to teach our social communities how to establish and maintain healthy financial habits.

While we didn’t get a chance to touch on whether or not financing 20-inch dubs was really a smart idea, our partners bestowed upon the chat a trove of ideas and resources and links to help you decide for yourself.

Here’s just a small recap of what you may have missed:

Q1: What is Financial Capability and how can someone attain it? #askVBA #FinancialCapability

— Veterans Benefits (@VAVetBenefits) April 11, 2019

A1- Financial capability means an individual has the knowledge, skills and tools they need to meet all their monthly financial obligations as well as any emergency situations that may arise. #AskVBA

— Financial Readiness (@DoDFINRED) April 11, 2019

A1: Knowing how to secure your financial wellbeing is one of the most important things in life. Financial capability means acting on this knowledge by identifying your goals, making a plan, paying off high-interest debt, living within your means, and building wealth. #askVBA

— SEC Investor Ed (@SEC_Investor_Ed) April 11, 2019

Q3- All veterans discharged under honorable or general under honorable conditions are eligible for services provided by @Military1Source, including financial counseling services, up to 365 days after their retirement, end of tour or discharge date: https://t.co/mB0oQ5llbz #AskVBA

— Financial Readiness (@DoDFINRED) April 11, 2019

A4: It pays to start early! Use our Compound Interest Calculator to see how the money you invest may grow over time: https://t.co/yaPp3rCgrh #askVBA pic.twitter.com/RlePjCX5yG

— SEC Investor Ed (@SEC_Investor_Ed) April 11, 2019

A4- There are many ways to reduce expenses and save money. We suggest first starting with a spending plan: https://t.co/zFeFcFhMgU #AskVBA

— Financial Readiness (@DoDFINRED) April 11, 2019

A7: If your employer offers a 401(k), take advantage of it, especially if there is a “match” for contributions. You get a tax break when you contribute to a 401(k). #askVBA #FinancialCapability

— SEC Investor Ed (@SEC_Investor_Ed) April 11, 2019

A7- Review your retirement options very closely such as matching, to ensure they maximize their retirement from the beginning. Our #BlendedRetirement booklet has some great information on retirement for Service members: https://t.co/oTDDc99zxY

— Financial Readiness (@DoDFINRED) April 11, 2019

A8: Be suspicious of any investment that sounds too good to be true. Claims that an investment is a “can’t miss” opportunity or promises “guaranteed” returns are classic warning signs of fraud! #askVBA

— SEC Investor Ed (@SEC_Investor_Ed) April 11, 2019

April may be #FinancialLiteracyMonth, but that doesn’t mean you should be concerned about your #FinancialCapability just one month a year. Please give a follow to @DoDFINRED and @SEC_Investor_Ed and make sure to reach out if you have financial questions or need resources! pic.twitter.com/D54JuNTiNm

— Veterans Benefits (@VAVetBenefits) April 11, 2019

Topics in this story

More Stories

For Veterans especially, the risk of identity theft is high, as criminals target reoccurring monthly benefits payments. Bad actors utilize stolen privacy information to exploit VA benefits, health care and pensions.

In this news post, we explore the various options designed to keep you in your home, offering hope and possible solutions for when/if you experience financial hardship.

Vietnam Veteran David Chee is among the many Native American Veterans and service members who have dedicated their lives to military service. Chee proudly served with the Army's 82nd Airborne, parachuting into the jungles of Vietnam. Chee now owns a home he purchased on Navajo tribal lands with the help of the VA Native American Direct Loan.

We have organized a non profit organization to help veterans get their benefits and understand their entitlements.

How can we get information and some presentations?