The U.S. Department of Veterans Affairs (VA) announced May 13 that Veterans who qualify for a VA Home Loan funding fee waiver are now being notified in their home loan eligibility certificate and disability compensation award letter.

The recent change to the Home Loan Guaranty program aims to improve benefits delivery to Veteran homebuyers.

“Through an internal quality improvement effort, VA has put a plan in place to better inform Veterans through key communications when the law allows VA to waive the fee for a Veteran,” said VA Secretary Robert Wilkie.

VA also modified the “home loan welcome” letter to make sure Veterans know they may qualify for a loan fee waiver, should they later obtain a VA disability compensation award.

Historically, VA tasked lenders with verifying the “exempt” status of Veteran homebuyers and the department would identify waiver cases using its own internal loan audit process or by relying on Veterans contacting VA directly. Further internal procedural changes will provide a more regular review of program data and VA will soon issue policy and procedural changes to ensure a Veteran’s up-to-date status for the fee waiver is correctly identified.

A major issue under review is how VA credits borrowers who, after loan closing, were awarded disability compensation with retroactive effective dates. The department is working to determine how far VA can go to provide relief, given the current restrictions of applicable laws.

VA’s ongoing quality review looked at millions of loans dating back to 1998 originations. Since the initiative is ongoing, VA has not totaled how many borrowers might be helped by the new efforts. VA notes that it routinely returns funding fees when appropriate. Since 2014, the department has provided an average total of $75-$100 million to roughly 5,000 Veterans each year.

More information about the VA funding fees and refunds is available in VA’s Lenders Handbook. Veterans who think they may be eligible for a refund should visit VA’s website at: https://www.benefits.va.gov/homeloans/purchaseco_loan_fee.asp.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

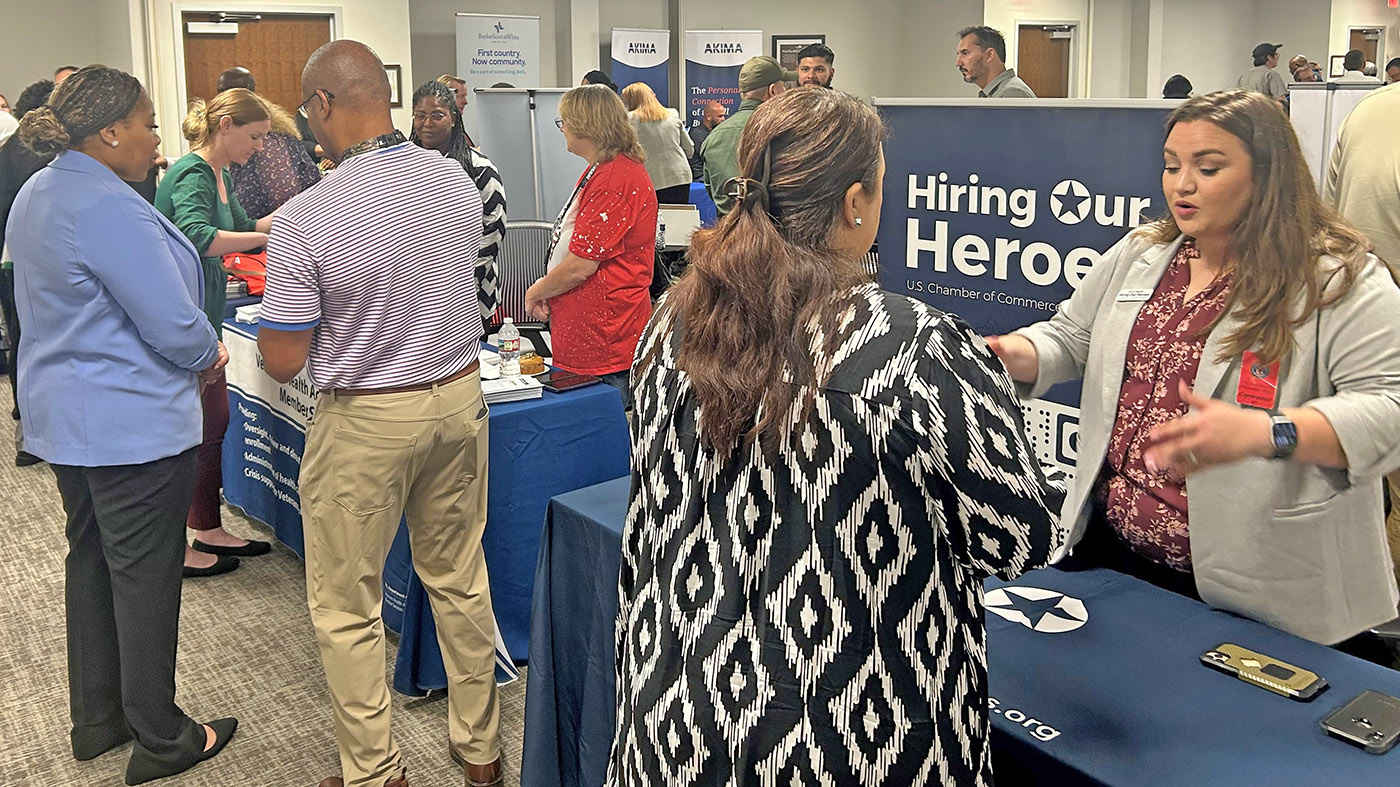

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

I am a 63 yr old male veteran. I have never received or asked to receive any government assistance of any kind even thru the VA.GOV. I recently found out that I could get a VA home loan and thus I purchased a modular home 1 1/2 yrs ago. This 1972 home has been a money pit. I even put down $30k upon purchasing the home. I have had roof leaks from the start. both washer and dryer quit working in the first year of occupancy. I recently discovered severe water damage on the floor and in the walls of my spare bedroom caused by my water heater whcih is not repairable. I am without hot water. My homeowner’s insurance will not cover my water heater because they say it has been determined to have been a long term problem. (due to mold in the bedroom and rust on the plate of the water heater.) This is a spare room that is not occupied very often. Therefore I was unaware of the water leakage until last week. Apparently, water had been already damaging the floor without my knowledge. I am unemployed and currently living off an inheritance I received which is soon to be depleted. I am worried about losing my home. I am frustrated trying to apply for jobs online. It is very difficult because I am not computer savvy. I have been unemployed for over a year now.. I could use some help in finding employment and assistance to help me refinance my home and/or fix needed repairs, i.e water heater, roofing, window insulation, etc. I am not educated or experienced on how to fix these repairs myself and I do not have the available funds. I am willing to work. I just do not know where to get assistance in these areas. I am going to apply for VA benefits for the first time including health benefits. If anyone can educate me on who, what, where I can possibly get some assistance, I would sincerely be forever grateful. Thank you for your time in this matter.

REJ

I have a question. My husband a 23.5 veteran passed away last year. I sold our small rural home. We had a VA home loan from 1983 to 1988. We have not had a VA home loan since. Is it possible for me as the widow of a veteran to receive a new VA loan to purchase a small place? Thank you.