With the 2020 hurricane season quickly approaching, FEMA is encouraging Veterans and their families to purchase a flood insurance policy from the National Flood Insurance Program (NFIP) to make sure their homes and belongings are protected ahead of the next storm.

FEMA is encouraging Veterans and their families to purchase a flood insurance policy from the National Flood Insurance Program (NFIP) to make sure their homes and belongings are protected ahead of the next storm.

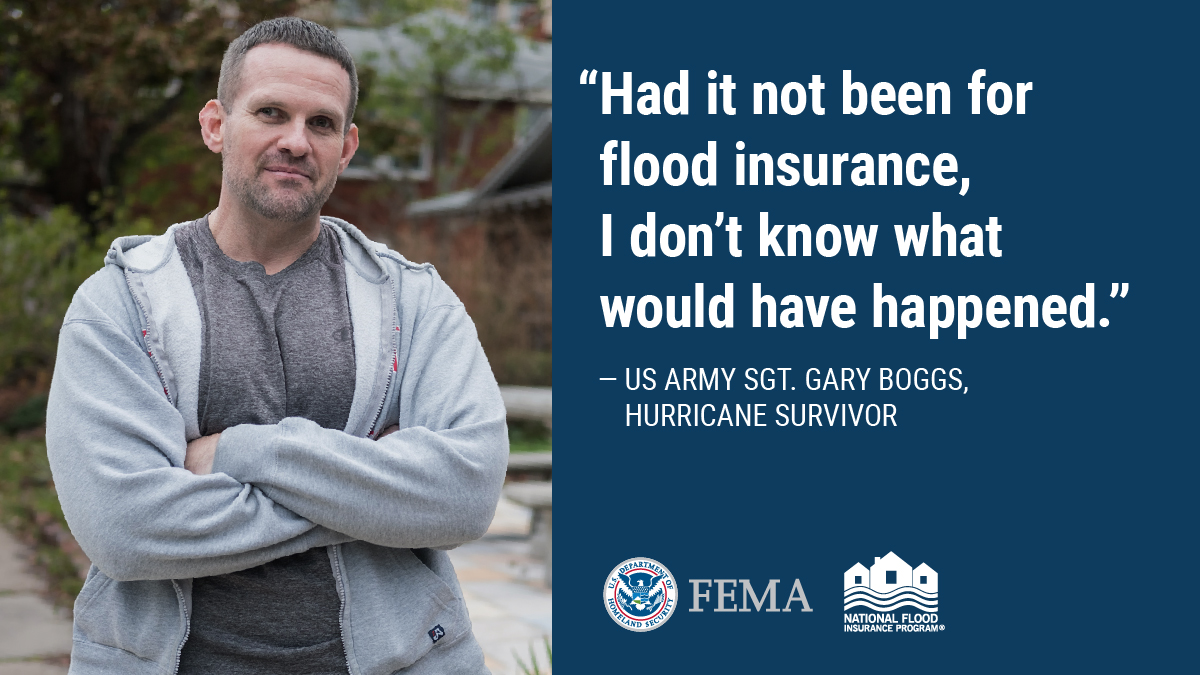

For U.S. Army Sergeant Gary Boggs from Jacksonville, Fla., purchasing flood insurance was a commonsense decision.

In 2004, after being struck by a roadside bomb while on duty in Iraq, Sgt. Boggs medically retired from the Army. To help support himself and his family, Sgt. Boggs decided to invest in a rental property; he knew that becoming a property owner meant having to be financially prepared for potential flooding.

“Part of being a responsible homeowner or property owner is having flood insurance. I wanted to protect my biggest asset,” said Sgt. Boggs.

When Hurricane Irma hit Sgt. Boggs’ rental property, the home filled with about a foot of water, destroying the floors, countertops, furniture and appliances. Had it not been for his NFIP flood insurance, Sgt. Boggs would have faced an uncertain financial future.

By working closely with his insurance agent, Sgt. Boggs was able to file a claim and receive an advance insurance payment, which helped him recover from the destruction. His agent also made sure that he found a restoration company and contractor to help with the repairs. Having flood insurance provided Sgt. Boggs with peace of mind knowing he could get back to doing the things he loved.

“With my flood insurance, I know there’s a light at the end of the tunnel. It’s like car insurance and homeowner’s insurance. You shouldn’t be without it.”

NFIP has got you covered

Flood insurance is a great way to not only make sure your home and belongings are covered in the event of a flood, but it helps protect you financially. Instead of having to dip into your savings to cover the cost of repairs caused by unexpected flooding, an NFIP policy has got you covered.

You can’t always predict the weather, but you can financially prepare for it by purchasing a flood insurance policy from the NFIP.

To learn more about the benefits of flood insurance, or to find a local flood insurance provider, visit FloodSmart.gov/find.

Topics in this story

More Stories

Soldiers' Angels volunteers provide compassion and dedication to service members, Veterans, caregivers and survivors.

Veterans are nearly three times more likely to own a franchise compared to non-Veterans.

The Social Security Administration is hoping to make applying for Supplemental Security Income (SSI) a whole lot easier, announcing it will start offering online, streamlined applications for some applicants.

I had flood insurance with FEMA and it kept going up by about $400 a year. I started at about $800 a year and ended the policy when it got to $2000 a year. I have had flood insurance with Lloyd’s of London for about 5 years now and it is still only around $800 a year. If you can I would have an agent look into them for you.

I live in Puerto Rico and my home is up in the mountains. I have a cement two story 4 bedroom and 2 1/2 bathroom home with a 2 car garage and a Pool.

I have never put a claim during hurricanes or earthquakes. I have protected my Home with hurricane window shields and doors. I am interested in flood insurance though I’ve never needed it cause my home is not in a flooding zone, but none the less you never know.

How much would flood insurance cost?

M

Flood insurance will keep going up in price! I think all most every year my premiums go up.

Who can afford it? Since buying my home the flood insurance has went from $300 to $3500 a year! With no claims!

Hire an appraiser to do an “elevation survey”. The elevation survey may put you above the flood zone and drastically reduce the cost of flood insurance. It worked for me and several of my neighbors after we were flooded with what FEMA called a “500 year flood” in 1994. No flooding since then.

John Stewart, when I asked the same questions over the past few years, I was told that the U.S. Congress had changed the formula for the cost of the Federal Flood Insurance Program and how the home owner pays for their premiums. The congress based their changes saying that the taxpayers were subsidizing the cost of the program for millions $ beach homes. And they said that is unfair so they upped the premium for everybody, including the same amount for homes valued at $150,000. So now that guy in the 3 story, 5 million $ beach house with 2 elevators pays a little more for his flood insurance. And so do you, the $22 an hr pipe fitter. I kind of see it as a similar deal as the congress’s health care plan and retirement package. Good work if you can get it.

I am a veteran with flood insurance. Year before last was $800, this year $1200. Next year I’ll need a loan to buy the next flood insurance increase. Why such a significant increase without a claim?