National Financial Awareness Day is devoted to teaching achievable financial principles to help you manage your finances, and VA is dedicated to ensuring Veterans are empowered and aware of all the tools and resources available to them.

Protecting your finances from fraudsters and scammers

VBA ensures that Veterans can apply for and claim the benefits they have earned, while protecting them from the fraudsters and scammers employing tricks and schemes to steal them. According to Disabled American Veterans (DAV), an estimated 16% of Veterans have lost money to fraud.

If you’ve received an email or phone call or letter about your benefits that just doesn’t feel right, stay vigilant:

- VA will never ask for your personal information via email.

- VA will never threaten you with jail or lawsuits.

- If you have any questions or doubts, contact VA at 1-800-827-1000.

One way to protect your monthly benefits is with the Veterans Benefits Banking Program (VBBP), which was created to encourage Veterans to enroll in direct deposit. In partnership with the Association of Military Banks of America and the Defense Credit Union Council (DCUC), VBBP provides Veterans with information on low- to no-cost banking options.

As a result, more than 85,000 Veterans opened bank or credit union accounts or signed up to receive VA benefits payments through direct deposit. Their benefits payments now are being transferred into an FDIC-insured bank or NCUA-insured credit union.

VA also focuses on financial literacy, including educating Veterans about how to reduce their debt, save for retirement and avoid scams. Case managers are also on hand to assist homeless Veterans with their financial needs, including if they become victims of theft or fraud. If they have been victimized, homeless Veterans can contact Help for Homeless Veterans at 1-877-4AID VET (877-424-3838) or go to va.gov/homeless.

VA is committed to protecting and educating Veterans – not just on National Financial Awareness Day, but year-round.

Topics in this story

More Stories

After a Veteran passes away, family members should report the death of the Veteran to VA as soon as possible to stop current benefits payments. If the death is not reported promptly, survivors or executors of the Veteran’s estate may have to repay any overpayments received.

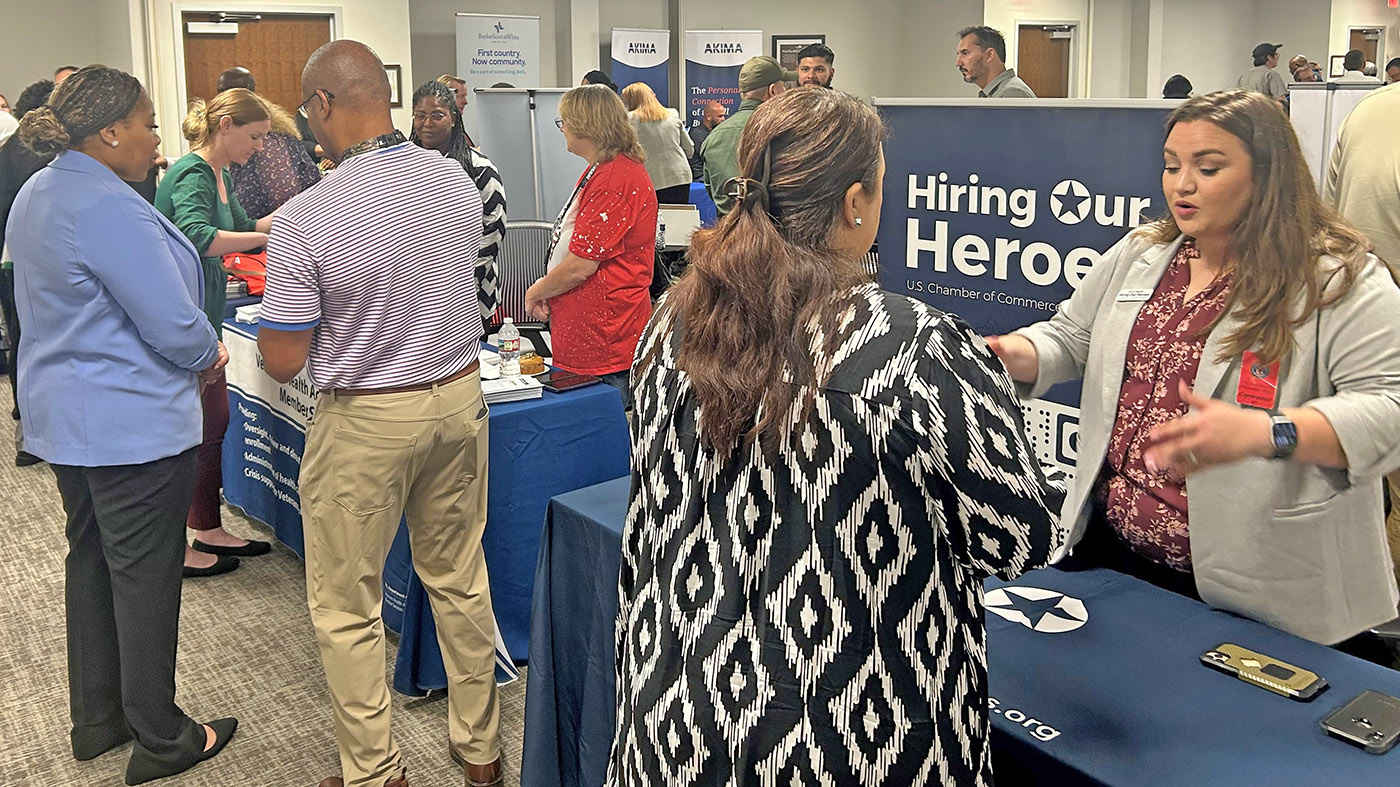

Supporting Veterans with job training, education, employment accommodations, resume development and job seeking skills coaching.

VA wants to ensure Veterans, including those who choose to have their private health care provider complete a DBQ, are appropriately equipped with the information they need to submit DBQs successfully.

I’m a disabled veteran and full-time truck driver and I am 65 . My wife and I have alot of high interest credit card debt and would like to consolidate it into one monthly payment. We are currently paying approximately 1400.00 a month and seems like we just can’t get ahead.