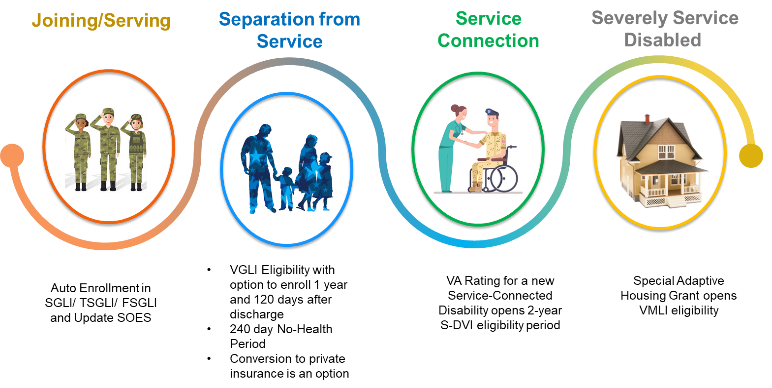

VA has provided life insurance for over 100 years to our nation’s service members, Veterans, and their dependents. Life insurance protects loved ones financially after the death of the insured. When selecting the coverage type and amount that is best for you, it’s important to keep in mind the purpose of life insurance, which includes income replacement, end of life costs, and financial flexibility.

VA Life Insurance offers several benefit options:

- Servicemembers’ Group Life Insurance (Serving)

- Family Servicemembers’ Group Life Insurance (Serving)

- Traumatic Injury Protection under Servicemembers’ Group Life Insurance (Serving)

- Veterans’ Group Life Insurance (Separation from Service)

- Service-Disabled Veterans Insurance (Service Connection)

- Veterans’ Mortgage Life Insurance (Severely Service Disabled)

Once you’ve identified the life insurance program that best suits your stage of the journey from service member to Veteran, VA offers a variety of products and services that make obtaining and maintaining a policy efficient and easy. The VA Life Insurance website has several key features that allow you to:

- Apply for coverage

- Select electronic payment options

- File claims

- Upload documents

- Download forms

In the near future, policyholders will have the ability to pay for premiums using a credit card.

VA Life Insurance consistently seeks out better ways to accomplish its mission and is committed to innovating and collaborating with stakeholders to design customer-centered processes and products. We welcome feedback to help us increase outreach and awareness.

For more information, visit www.benefits.va.gov/insurance.

Topics in this story

More Stories

In this news post, we explore the various options designed to keep you in your home, offering hope and possible solutions for when/if you experience financial hardship.

Vietnam Veteran David Chee is among the many Native American Veterans and service members who have dedicated their lives to military service. Chee proudly served with the Army's 82nd Airborne, parachuting into the jungles of Vietnam. Chee now owns a home he purchased on Navajo tribal lands with the help of the VA Native American Direct Loan.

For Veterans, donating to charities—especially those that support fellow service members—feels like a meaningful way to give back to the community. However, Veterans and their loved ones must remain vigilant and learn to protect themselves from charity scams.

I am 77 Years old and a Viet Nam Vet, & suffer from Agent Orange disability 70%,suffer from HBP, and diabetes would I qualify from coverage?

I am a Vietnam area veteran who is fighting for his disability i have been fighting for 9 years and finally getting a hearing in 3 months can i get insurance i am also 76 years old.

74 100% service connected disabled . Cost life insurance

When I got out of active duty they offered SGLI I have been paying premiums ever since do I qualify for VGLI??

J

Vietnam Vet, 69 years old. How much cost and coverage is available?

Interested in life insurance for Vet who served 4 years 1965-1969. I have been healthy and athletic all my life.

I am in good health. I have a good workout to maintain my shape and weight control inspire of Covid-19. I tested 3 times without Covid infection.

i am 70 % and would like more information to get life insurance with you institute please send more information

[Editor: Please read the info in the blog and click the links for more on eligibility and how to contact VA for this service.]

Why don’t you just call them or research like everyone else does. That’s the quickest way to get answers. But you may be in the wrong place. This is not a institute, are you looking for a school or something? Are you looking for the Art institute?

100 % disabled will turn 77 on 3 Feb 21. am I to old and/or what would it cost?

I’m an 18 year vet with no pension, but want insurance

I am interested

My husband is a disabled vet and needs life insurance. Do you have a policy that would be affordable for him. He is 71.

[Editor: Please click on the links in the blog to read about VA’s insurance options and eligibility. The blog also contains contact information if you have other questions.]

just want to know. We both need something we can afford?

My husband got out of national guard in 2003 after 23 years He is 100 percent disable Can we get life insurance now for both of us?

Are Retirees egible for any of these programs?

Yeah, unfortunately you are correct. I received the letter. It doesn’t make sense though, why are there time constraints? It’s just a life insurance policy. The requirements of 2 years is generous, but why the need? It should be open enrollment anytime. Does anyone know why the time limits?

I’m Interested.

What about those of us service connected vets that was not told about this insurance and now we are not in the time frame it’s not fair that we can’t get it

[Editor: Derrick, when a Veteran is granted service connection for a disability, the notification comes in a letter via USPS. In that letter is your “percentage,” but more importantly, it also contains information on VA benefits that the Veteran becomes eligible for, including VA life insurance. Please re-read your letter, or click on the links in the blog to read more about each type of insurance VA provides to determine your eligibility.]

I am requesting life insurance in the amount of 150k to 200k but not willing to pay over $90.00/month. I am 52 years old. I would like to get a quote on term and fixed.

[Editor: This is a blog, with news and information. Please click on the links in the blog to read about VA’s insurance options and eligibility. The blog also lists ways to contact VA about your questions and desires.]