Financial Literacy Month provides an opportunity to get caught up on often overlooked end-of-life planning. VA offers programs to assist with end-of-life planning and help ease the burden on family members when a Veteran passes.

Knowing the importance of life insurance coverage and what the common types are helps Veterans and their families secure a financial future.

Life insurance can be affordable and accessible to people at all income levels. A wide array of factors determines life insurance cost.

Every week, VA sends a newsletter that is jam-packed with resources like free concert tickets, farming assistance, workout programs, national park passes and Veteran discounts on hundreds of services.

Summer brings longer days and a slower pace, which means that you’ve got more time on your hands to consider your finances. As a Veteran, your financial resources may already include benefits you earned through your service, such as your Thrift Savings Plan (TSP) account or, if you retired from the military, your retired pay and perhaps the Survivor Benefit Plan (SBP). But what about life insurance?

Talking about end-of-life planning is never easy, but it is essential. VA provides a variety of benefits and services to help Veterans and their loved ones prepare. From life insurance to burial costs, learn how you can plan ahead with VA benefits.

From the moment the pandemic hit, VA’s public servants mobilized around one core mission: provide world-class care and benefits to Veterans, their families, caregivers, and survivors during this time of need. Throughout the pandemic, our public servants executed that mission by risking their own lives, sacrificing time with their families, sleeping overnight at hospitals, and much more – all to save and improve the lives of Veterans.

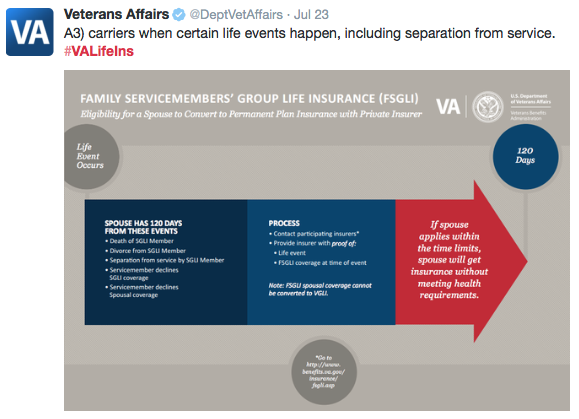

On July 23, we partnered with Team Rubicon for a Twitter chat about VA life insurance. Here's a summary of the top questions.

Director of the Department of Veterans’ Affairs Insurance Center On this day 100 years ago, Congress passed the War Risk Insurance Act that later became the catalyst for what is now known as VA life insurance protection.