The IRS Direct File pilot offers eligible taxpayers in 12 states a convenient and free way to file their taxes directly with the IRS. This initiative, which has been eagerly awaited by many, simplifies the tax filing process and is now accessible to individuals residing in Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington and Wyoming.

Advantages of IRS Direct File

- Swift Filing: Taxpayers can complete their 2023 federal tax returns in as little as 30 minutes using a mobile device.

- Guided Input: The platform provides step-by-step guidance for adding tax information, ensuring accuracy and completeness.

- Real-time support: Users can connect with IRS customer service representatives for real-time assistance.

- Device compatibility: Accessible from smartphones, laptops, tablets and desktop computers, offering flexibility to taxpayers.

- Fast refunds: Eligible individuals can expect to receive their federal tax refunds in less than 21 days.

Eligibility criteria

The IRS Direct File pilot caters to taxpayers with simple federal tax returns in the participating states who report income from the following sources:

- W-2 wage income

- SSA-1099 Social Security income

- 1099-G unemployment compensation

- 1099-INT interest income of $1,500 or less

Participants in the Direct File pilot must opt for the standard deduction and are limited to claiming deductions for student loan interest and educator expenses.

If Direct File isn’t an option, there are many other filing options available.

State Tax Returns

While the Direct File pilot focuses on federal returns, taxpayers residing in Arizona, California, Massachusetts or New York can utilize state-supported tools recommended by the pilot for preparing and filing state tax returns.

How to Learn More

- Check eligibility: Taxpayers can verify their eligibility for the IRS Direct File pilot.

- Stay informed: Stay updated with the latest news about the pilot by visiting the Direct File pilot news section, subscribing to the Direct File pilot newsletter, or exploring Direct File on IRS.gov.

Additional Resources

- Direct File Pilot Overview (IRS YouTube video)

- IRS Publication 5916, File for Free with Direct File Pilot

- IRS Publication 5917, Direct File Pilot – What You Need to Know

Subscribe to IRS Tax Tips

Stay ahead with valuable tax tips and updates by subscribing to IRS Tax Tips.

This initiative not only simplifies tax filing but also ensures that eligible taxpayers can access the benefits they are entitled to efficiently and conveniently. Explore the IRS Direct File pilot today to experience hassle-free tax filing.

Topics in this story

More Stories

Each week, we receive job announcements from employers and employment websites—including RallyPoint, RecruitMilitary, VetJobs and HireMilitary—looking to hire Veterans. This post contains links to job listings for the week of July 22, 2024. Each week, we’ll continue to post relevant and timely listings as we receive them, and for the locations listed.

VA hosted its second virtual regional Veterans Experience Action Center (VEAC) June 11-13 as part of a series targeting recently separated Veterans and military members nearing transition out of the armed services.

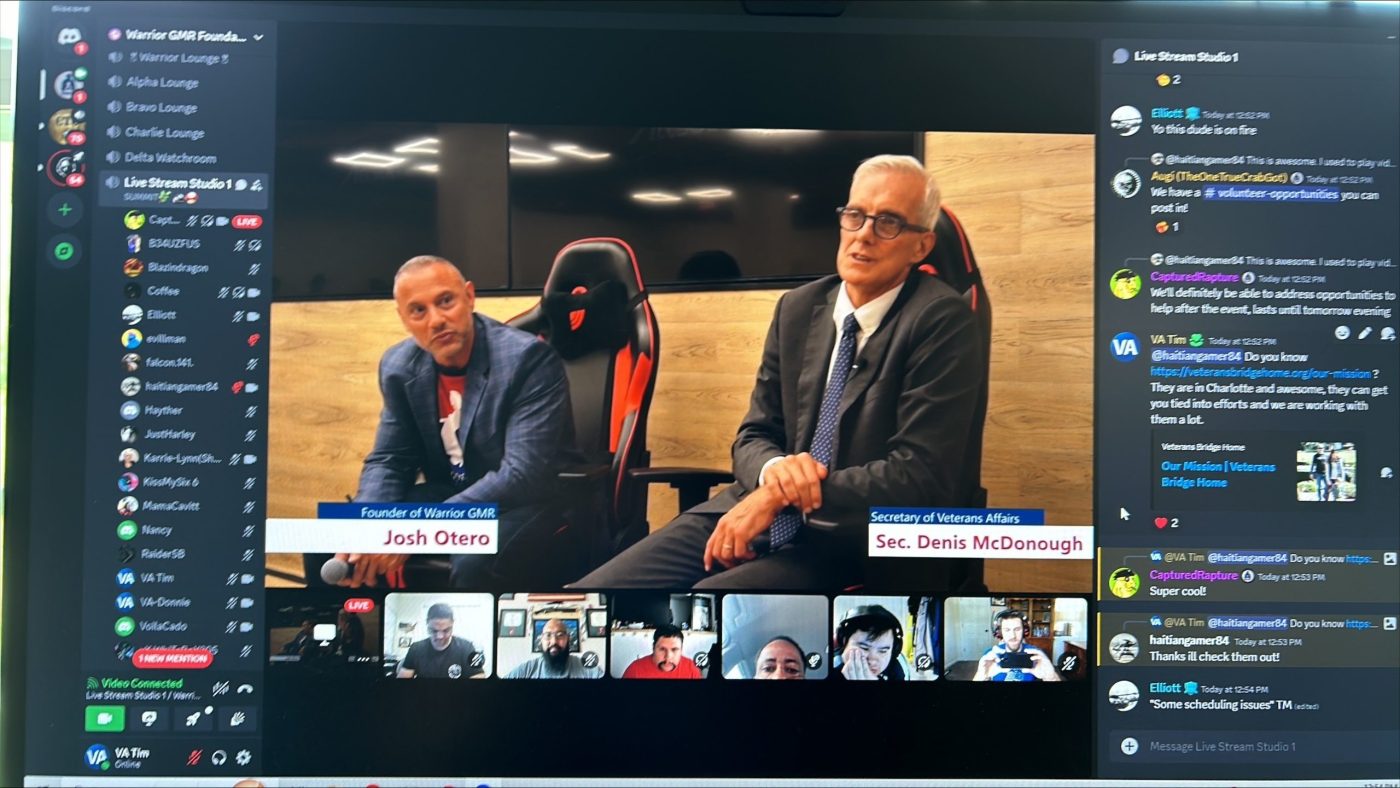

VA Secretary Denis McDonough spoke to Veteran gamers at the Warrior GMR Mental Health and Gaming Summit July 12 in Washington, D.C.

I live overseas with no US address can I still use this to file?

Are VA widows eligible for this service?

lots of outside doctors’ information like diagnosis, and hospitalization, were left out during my VES evaluation, to make worst I wasn’t even present just got out of V.A. Lake Nona hospital after staying 3.5 days after a catheterization in my left leg and an enterectomy femoral artery blockage without a pulse.

did call to re-schedule but I wasn’t granted, they did an incomplete evaluation.

Patient

John Calderon