Looking to purchase a home? First-time and experienced homebuyers alike may be able to take advantage of VA’s home loan programs. Plus, VA offers housing-related assistance programs for Veterans with certain severe service-connected disabilities.

VA and the National Association of Realtors (NAR) discussed these programs in detail during the #ExploreVA Facebook Live event on June 28 with Maxine Henry, Program Analyst for VA Loan Policy, and Sehar Siddiqi, Federal Housing Policy Representative for NAR.

Henry and Siddiqi provided participants with information about the benefits associated with VA home loans and other housing-related programs, such as mortgage refinancing and adapted housing grants.

“The VA home loan program is a benefit that’s earned based on service to our nation,” says Henry. “There’s no down payment required in most instances, there’s no mortgage insurance required and [it has] very flexible credit underwriting guidelines.”

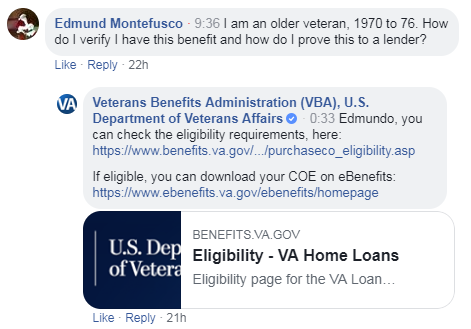

To receive a VA home loan, the first step is for the Veteran to obtain a certificate of eligibility (COE). “That is the only document that will let the lender know that one is eligible,” says Henry. “Then you want to be pre-approved by a lender.”

To select a home, Henry and Siddiqi recommend enlisting the help of a real estate professional. They also shared information about grants to help eligible service-connected Veterans live independently and fielded a few questions from the audience.

VA representatives were available after the conversation to respond to questions and direct Veterans to resources.

You can encourage Veterans in your network to head to Explore.VA.gov to learn more about these home loan programs and apply for an adapted housing grant.

If you missed this event, check out some of the highlights below.

Several participants were curious about eligibility requirements.

The audience wanted to know more about verifying their home loan benefit. Veterans can download their COE here.

Henry spoke about the types of homes Veterans can purchase using their home loan, such as single-family homes, townhomes and condos. Veterans asked about using the loan for additional reasons, such as purchasing land.

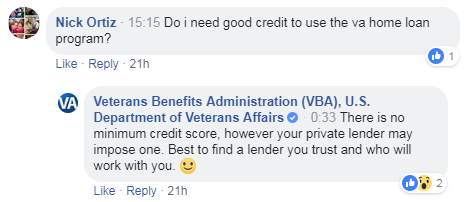

VA representatives answered questions pertaining to credit scores. There is no minimum credit score to qualify.

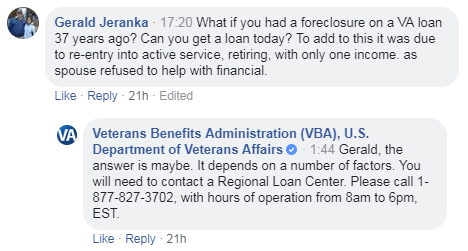

What about foreclosures? VA encouraged Veterans to contact their Regional Loan Center to find out about eligibility after a foreclosure.

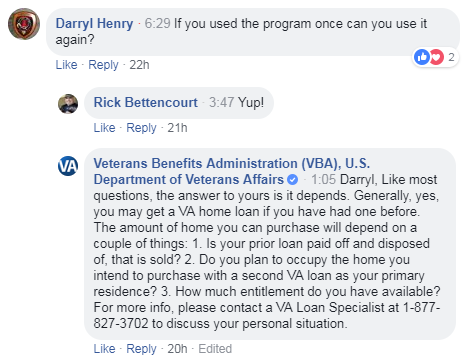

Many Veterans wanted to know about using the benefit more than once. Qualified Veterans can reuse this benefit again and again.

Thank you to all Veterans, service members and their supporters who participated in the event. Stay tuned to the ExploreVA events page for information about upcoming event.

Topics in this story

More Stories

When Max Zaruba sliced his finger in a freak accident, he wasn't expecting a Marine reunion inside the Milwaukee VA until he saw his old buddy from Iraq.

Kristine Roberts doesn’t remember the motorcycle accident, but still deals […]

The MISSION Act will strengthen the nationwide VA Health Care System by empowering Veterans with more health care options.