VA has resources available to ensure natural disasters do not make the already challenging situation of owing a VA debt worse. If you are experiencing financial hardship and are unable to repay your VA debt because of a natural disaster, relief options are available.

Arm yourself with the knowledge you need to be safe online when it comes to financial services, debt scams and junk fees targeting Veterans.

In honor of Veterans Day, Ramsey Solutions will offer up to 10,000 Veterans free financial wellness training and advice through its nine-week Financial Peace University (FPU).

Match Day marks an important milestone for physicians. For the many new residents who make their way to VA to begin work, there’s a bright future ahead.

On Oct. 4, 2023, President Biden announced that an additional 125,000 Americans have been approved for $9 billion in debt relief through fixes the U.S. Department of Education has made to income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF), and granting automatic relief for borrowers with total and permanent disabilities.

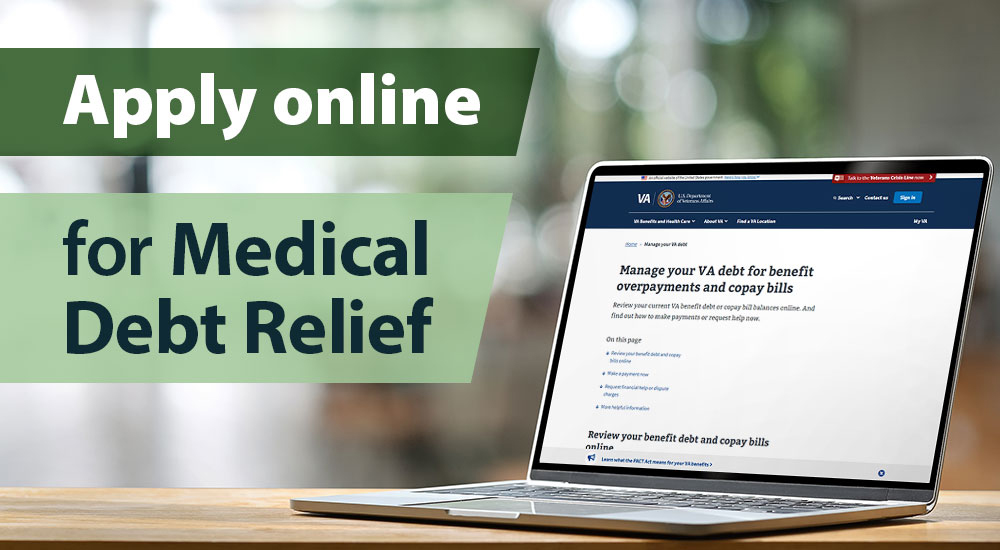

VA has simplified and streamlined the application process for medical debt relief, allowing Veterans better access. Apply for and receive medical debt relief now.

Summer brings longer days and a slower pace, which means that you’ve got more time on your hands to consider your finances. As a Veteran, your financial resources may already include benefits you earned through your service, such as your Thrift Savings Plan (TSP) account or, if you retired from the military, your retired pay and perhaps the Survivor Benefit Plan (SBP). But what about life insurance?

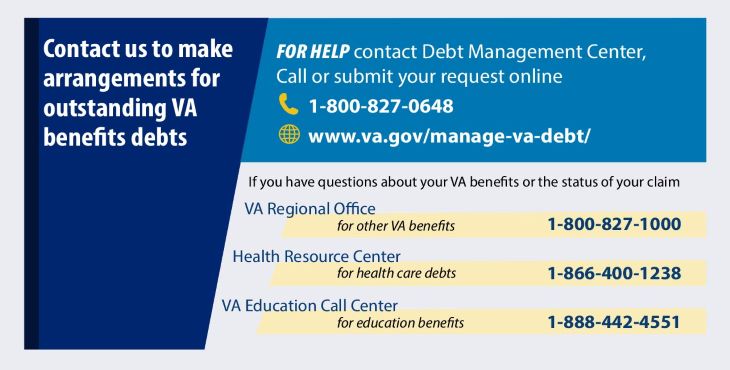

It’s vital that Veterans have the tools they need to access the benefits they’ve earned and deserve. To help Veterans apply for and receive VA benefits more efficiently, VA’s Office of Information and Technology (OIT), Veterans Benefits Administration (VBA), and Debt Management Center (DMC) have been working to create innovative technology solutions.

VA has resources to help Veterans prevent fraud—and the stress that can come with it if you've been victimized.

Recently, VA announced that Veterans have the option to request a temporary benefit debt suspension through December 31, 2022. Here are five ways that VA has been making repaying a VA debt less stressful.

It’s never too early to think about ways to pay off your student loans. We’re thinking about it today, on March 17, as fourth-year medical students all over the country look to the future and find out where they will be doing their residency on Match Day.

VA needs physicians with a variety of specialties, like urology, to make sure the Veterans we serve get the best care possible, and we offer plenty of employment benefits to make it worth your while.